Access to Justice—Litigation Funding and Group Proceedings: Consultation Paper

2. Policy context

Introduction

2.1 The terms of reference set out a list of specific issues concerning the supervision of proceedings funded by litigation funders and the regulation of class actions. These issues are discussed in Chapters 4–8. This chapter contains an overview of the context in which the issues arise.

2.2 It is often said that litigation funders provide access to justice through class actions by enabling class members to participate in legal action that otherwise would be too costly for them to pursue. It is also said that there would be even greater access to justice if lawyers could charge contingency fees as well.[1] The first part of this chapter describes the financial risk of undertaking litigation and how it can be reduced by litigation funders and lawyers and, when appropriate, class action proceedings. The discussion then turns to why lawyers are prohibited from charging contingency fees for their legal services.

2.3 Following this discussion is an overview of class action procedures—specifically those for group proceedings under part 4A of the Supreme Court Act 1986 (Vic). Because the Commonwealth scheme that the Victorian legislation replicates has existed since 1992, it is possible to look back over 25 years of class actions to gain a sense of who may be exposed to unfair risks or disproportionate cost burdens and why.

2.4 The remainder of the chapter discusses two factors that have changed the way in which legal services are provided and funded, and class actions are conducted, in Australia: the growth of the litigation funding industry and the increased entrepreneurialism of legal services. Although a few major litigation funders and law firms have been at the forefront of these changes, both the litigation funding and legal services markets are evolving constantly and new competitors are having an effect on the balance of competing interests within the Commonwealth and state class action regimes.

2.5 Whether this is cause to regulate the litigation funding industry, or justification for not doing so, has been a topic of active debate for many years, and is the subject of a number of government reviews. As will be discussed in Chapter 3, the regulation of the industry is primarily a matter for the Commonwealth Government. It is relevant to the terms of reference of this review, but is not an issue on which the Commission has been asked to report.

Litigation costs

The cost-shifting rule and financial risk

2.6 The costs of litigation are typically the lawyer’s fee plus the costs incurred by the lawyer in support of the litigation (disbursements).

2.7 Under the cost-shifting rule, the court usually orders the unsuccessful party to pay the other side’s costs. This is known as an adverse costs order. The principle is generally known as ‘costs follow the event’.[2]

2.8 In practice, the costs order covers only the successful party’s reasonable legal costs, which are known as party/party costs. These costs are calculated from a standard scale which sets the amount that is recoverable from the losing party for work done.

2.9 The scale of costs reflects the level of importance of the matter, so cases in the Supreme Court are remunerated at a higher level than cases in the Magistrates’ Court. Actual legal fees in litigation commonly exceed those set out in the scale. The difference is known as solicitor/client costs.

2.10 The prospect of paying an adverse costs order as well their own costs if they lose can represent a significant risk to anyone contemplating legal action. Not only might it be necessary to shoulder a greater financial burden, there is no way to determine how much it might be. One party cannot control the legal expenses incurred by the other, which can be substantial when the other party is well resourced.

2.11 In addition, in some circumstances the court may order the plaintiff to pay, or prove that they can pay, the defendant’s costs before the litigation proceeds any further.[3] This is known as a ‘security for costs order’.

2.12 The advantage of the cost-shifting rule is that it discourages legal action that has no merit or is speculative. It is often identified as a key reason why the amount of litigation in Australia has not reached the levels experienced in the United States, where the rule does not apply.[4] The disadvantage is that the financial risk and burden deter those with legitimate claims from enforcing their rights.

2.13 For some of the most vulnerable members of the community, the financial risk and cost of litigation can be reduced with the assistance of publicly funded and pro bono legal services. In its 2014 report, Access to Justice Arrangements, the Productivity Commission estimated that eight per cent of households meet the income and assets tests for legal aid.[5] The remainder, including most middle- and low-income earners as well as those on higher incomes, and commercial entities, have to find other ways of meeting the costs of taking legal action.

2.14 For some, financial arrangements offered by litigation funders and law firms can reduce the financial risk by indemnifying the plaintiff for some or all of the costs of losing. In return, the costs paid by the plaintiff if the litigation succeeds are greater. A litigation funder will take a percentage of the settlement negotiated by the parties or the damages awarded by the court, while the law firm will charge a premium on its usual fees. In class actions, both a litigation funder and a law firm will be involved—and possibly an insurer as well. Their combined share can be as much as, or more than, the plaintiff’s. Whether these arrangements should be placed under greater scrutiny and control by the court is discussed in Chapters 5 and 7.

Funding agreements with litigation funders

2.15 Typically, the litigation funder enters an agreement with the plaintiff to meet the costs of the litigation. Terms vary, but the funder is likely to pay the legal fees and disbursements directly to the plaintiff’s lawyers. The funder usually also agrees to provide any security for costs that the court orders the plaintiff to give, and to pay any adverse costs orders if the litigation is unsuccessful.

2.16 The plaintiff agrees to reimburse the litigation funder out of any funds recovered by way of damages awarded by the court or settlement negotiated by the parties. Money received from the defendant for the plaintiff’s legal costs will be directed to the litigation funder. The funder also receives a percentage of the damages or settlement amount, which is calculated either on the full amount recovered or on the amount remaining after reimbursement. This is known as the ‘funding fee’.

2.17 The percentage of the recovered funds that litigation funders charge in return for their services varies. The typical range appears to be between 20 and 45 per cent,[6] although in some insolvency cases it has been 75 per cent.[7]

2.18 Although the funding agreement is executed by the plaintiff, the terms are often negotiated between the funder and the plaintiff’s law firm. This is seen particularly in class actions, where there is a complex tripartite relationship between the litigation funder, the law firm and the representative plaintiff.[8]

2.19 The litigation funding agreement is at the core of the issues raised by the terms of reference not only because it determines the allocation of risks, costs and rewards, but because it provides the framework for the relationship between the funder and the law firm.[9] The Commission has been told in preliminary discussions with a number of stakeholders that there are serious concerns about conflicts of interest, which are heightened when there is inadequate disclosure to the plaintiff. Disclosures to plaintiffs are discussed in Chapter 4. Questions about the distribution of the amount recovered are raised in Chapter 7.

Conditional costs agreements with law firms

2.20 Law firms in Victoria have long been able to charge on a conditional or ‘no win, no fee’ basis.[10] Under a conditional costs agreement, the plaintiff pays no legal fees if the litigation is unsuccessful. If it is successful, the plaintiff pays the fees plus a premium (or ‘uplift fee’) of not more than 25 per cent of the legal costs payable (excluding disbursements).[11] The plaintiff is usually required to meet all other costs that arise, including for disbursements and any adverse costs order.

2.21 The uplift fee compensates the law firm for taking on the risk of not being paid at all if the litigation is unsuccessful. The agreement must identify the basis on which the uplift is to be calculated and an estimate of how much it will be.

2.22 If the litigation succeeds, the other party will pay some of the plaintiff’s costs, but not the uplift fee.[12] However, Funds in Court, an office of the Supreme Court of Victoria, told the Productivity Commission that lawyers almost invariably charge the full 25 per cent uplift fee regardless of the risk involved, even where the plaintiffs have a strong case with no prospect of losing.[13] It also appears that law firms are paid an uplift fee even when the proceedings are funded, and the risk shouldered, by a litigation funder.[14]

2.23 The Legal Profession Uniform Law, at schedule 1 of the Legal Profession Uniform Law Application Act 2014 (Vic), sets out the minimum details that a conditional costs agreement should contain; what the client should be told; and the sanctions for lawyers who do not comply.[15]

2.24 Conditional costs agreements are sometimes seen as a form of litigation funding because the law firm takes on some of the risk that the plaintiff otherwise would have to bear. The terms of reference specify that the term ‘litigation funder’ is not intended to apply to lawyers acting on a conditional basis. While the Commission is not reviewing conditional costs agreements, the way in which these agreements are regulated is relevant to any discussion about the regulation of litigation funding agreements.

‘After the event’ insurance

2.25 ‘After the event’ insurance protects the insured against the risk of having to pay the other side’s costs if they lose. The cover also typically includes any adverse costs order against the insured and their disbursements, but not legal costs.[16] Unlike standard insurance policies, which are purchased before an event that would trigger payment occurs, after the event insurance is purchased once a dispute has arisen or specific proceedings are contemplated.

2.26 The premium is usually payable only if the litigation is successful. The cost is variable.

The sooner the case is resolved in the plaintiff’s favour, the lower the premium. However, if the other side refuses to settle and the case proceeds to trial, the risk is greater and so is the premium. The cost of after the event insurance tends to be between 20 and 40 per cent of the policy indemnity limit.[17]

2.27 After the event insurance is prevalent in the United Kingdom. It was encouraged by government as a means of improving access to justice by overcoming the deterrent effect of the cost-shifting rule. It is usually linked to a funding agreement with a litigation funder or a conditional cost agreement with a lawyer. Where there is no litigation funder, after the event insurance can complement a conditional costs agreement with a lawyer, by covering the risk of having to pay an adverse costs order and disbursements. If a litigation funder is involved, after the event insurance can provide security of costs, thereby reducing the funder’s exposure and freeing up funds that otherwise would be paid into court.[18] In either case, the plaintiff bears no risk.

2.28 The Commission has been told that after the event insurance policies are not widely used in Australia because of the high cost of the premium. In addition, the cost of the premium cannot be recovered from the losing party in an adverse costs order. After the event insurance did not become popular in the United Kingdom until the premium was made recoverable.[19]

2.29 Most policies taken out in Australia are from brokers operating overseas. The Commission was told that there may be only one major insurance broker based in Australia offering a policy of this type.[20] However, it does appear that after the event insurance is increasingly being used in conjunction with litigation funding agreements and/or conditional costs agreements. If the litigation is successful, the premium is another cost taken out of any funds recovered (in addition to deductions for the litigation funding fee, legal costs and disbursements) before the plaintiff receives their share.

The ban on contingency fees for legal services

2.30 Contingency fees, also referred to as ‘proportionate fees’, ‘damages-based billing’ or ‘percentage-based contingency fees’, are payments calculated as a proportion of the result achieved. Litigation funders charge a contingency fee, expressed as a percentage of the amount recovered by way of damages awarded by the court, or by settlement negotiated by the parties.

2.31 In Australia, lawyers are prohibited from charging contingency fees. In Victoria, the Legal Profession Uniform Law states that any contravention of the prohibition will constitute professional misconduct and attract a civil penalty.[21] However, long before the ban was articulated in legislation, it existed at common law.

2.32 Its origins lie in the common law crime and tort of maintenance and champerty. Maintenance is the ‘procurement by direct or indirect financial assistance of another person to institute or carry on or defend civil proceedings without lawful justification’.[22] Champerty is a form of maintenance in which a share of the proceeds of the litigation is agreed as the reward for the assistance given.[23] Both seek to prevent litigation processes being subverted by someone who is not a party to the proceedings and has a financial interest in achieving a particular result.

2.33 Maintenance and champerty were largely abolished in Victoria many years ago,[24] but the prohibition on lawyers being rewarded from the proceeds of litigation has been retained through successive legislation for regulating the profession. The ban is underpinned by public policy concern that contingency fees create perverse incentives for lawyers who have a direct financial interest in decisions affecting the litigation they are involved in.[25]

2.34 The constancy of the ban belies the fact that there has been long and robust debate about whether it should be removed.[26] The legal profession is divided. While the Law Institute of Victoria has advocated for the introduction of contingency fees for lawyers since 1988,[27] the Legal Services Commissioner opposes the idea,[28] as does the Victorian Bar.[29] The Law Council of Australia settled on a position in support of the status quo only after thorough reappraisal of the arguments for change.[30]

2.35 Since 1988, at least 10 Victorian and Commonwealth parliamentary and government reports—including the Commission’s 2008 Civil Justice Review—have considered contingency fees.[31] The arguments most often made both for and against the ban are summarised in the Appendix (see page 124).

2.36 The key arguments for retaining the ban are that allowing lawyers to charge contingency fees would:

• create conflict of interest between the lawyer’s duties to their client and the court and their own financial interest in the outcome of litigation

• encourage litigants to pursue unmeritorious cases because it removes a financial impediment to litigation, which may prompt an epidemic of unreasonable litigation against corporate defendants who may be willing to settle to avoid the nuisance of litigation

• generate fees unrelated to the value of the work performed, whereas fees should properly reflect the nature of the legal services provided.

2.37 Advocates for lifting the ban have commonly put forward the following reasons:

• Lifting the ban would increase access to justice by removing or reducing cost disincentives. Contingency fees transfer some of the risk from the client to the lawyer, who is better able to assess the risk.

• Contingency fees are routinely charged by litigation funders, who are often directly involved in decision making about the progress of the cases they fund. They are now also routinely charged by some accounting firms providing assistance in connection with litigation; liquidators; costs consultants; and other companies providing services in connection with litigation.

• Consumers of legal services would have an easier way to compare legal services fees and have more choice.

2.38 The terms of reference ask whether lifting the ban would assist in mitigating issues presented by the practice of litigation funding; they do not call for the Commission to review whether the ban should be lifted. However, in addressing this question, the pros and cons of removing the ban need to be taken into account. This issue is discussed in more detail in Chapter 8.

Class actions

2.39 As discussed in Chapter 1, Victoria’s class action regime was established by part 4A of the Supreme Court Act in 2000. It is closely based on part IVA of the Federal Court of Australia Act 1976 (Cth) that commenced in 1992.

2.40 Both the Victorian and Commonwealth regimes were based on existing representative action procedures in each jurisdiction that had not been widely interpreted.[32] They are still available today. In Victoria, representative proceedings may be brought under order 18 of the Supreme Court (General Civil Procedure) Rules 2015 (Vic) where ‘numerous persons have the same interest in any proceeding’. Any one or more of those persons may represent some or all of the others.

2.41 The introduction of class actions increased the scale of proceedings. Hundreds of individual plaintiffs are able to seek compensation for mass wrongs through the legal system for large-scale losses caused by government agencies, corporations or other large defendants. Their losses can be recovered more efficiently and at less individual cost.

2.42 With the subsequent introduction of class action regimes in New South Wales[33] and Queensland,[34] both largely modelled on the Commonwealth legislation, and the possibility that Western Australia will follow suit,[35] large-scale litigation of this type is a well-entrenched feature of Australia’s legal landscape.

Overview of the Victorian scheme

2.43 The procedures for class actions in the Supreme Court of Victoria are set out in the Supreme Court Act, the Supreme Court (General Civil Procedure) Rules 2015 (Vic) and the Court’s practice note on the conduct of class actions.[36] They are discussed in detail in Chapters 3–7. The following is a brief overview of the Victorian scheme.

2.44 A class action—or, to use the language of the legislation, a ‘group proceeding’—can be brought when seven or more persons have related claims against the same defendant. The claims must be ‘in respect of or arise out of the same, similar or related circumstances’. Each must ‘give rise to a substantial common question of law or fact’.[37]

2.45 The proceedings are commenced by a representative of the class, who takes on the role of plaintiff. In this paper, the representative is called the ‘representative plaintiff’.[38] The representative plaintiff is typically selected by the group’s lawyers. Only the representative plaintiff is liable for any cost orders. The other members of the class are generally not liable.[39]

2.46 The membership of the class is not confined to the participants in the proceedings. All members are included unless they expressly exclude themselves, or ‘opt out’. In practice, this means that a class action can begin without the express consent of every member.[40] A member who does not opt out is bound by the outcome of the proceeding.[41]

2.47 The opt out approach was adopted to promote access to justice. Class members who cannot be identified at the outset, or who are unable to participate due to social or economic barriers, are not excluded from the legal system and a potential remedy.[42]

2.48 Unlike international practice, there is no preliminary approval or certification procedure whereby the representative plaintiff proves to the Court that certain preliminary criteria have been met and that the case should go forward as a class action. Instead, the onus is on the defendant to challenge whether the proceedings should continue as a class action or by some other means.[43] The terms of reference raise the question as to whether there should be a certification process. This is discussed in Chapter 6.

2.49 The Court has broad powers to supervise and manage the proceeding. Apart from its powers to determine a range of procedural requirements, it has the power to make any order it thinks appropriate or necessary to ensure that justice is done.[44] Over time, the degree of judicial scrutiny of class action settlements, litigation funding charges and the distribution of settlement proceeds has been increasing.[45]

2.50 A class action may not be settled or discontinued without the Court’s approval.[46] Most are settled.[47] The Court may make such orders as it thinks fit about the distribution of any money paid under a settlement or paid into court, including interest.[48] It will also require notice to be given to class members[49] and a hearing as to whether the settlement is ‘fair and reasonable’.[50] Issues concerning settlement are discussed in Chapter 7.

Impact on access to justice

2.51 Class action regimes are expected to improve access to justice by resolving disputes more efficiently and reducing costs for the parties and the courts. When debating legislation to establish the Commonwealth regime under part IVA of the Federal Court Act, the Commonwealth Attorney-General said that the regime was intended to achieve two objectives:

The first is to provide a real remedy where, although many people are affected and the total amount at issue is significant, each person’s loss is small and not economically viable to recover in individual actions. It will thus give access to the courts to those in the community who have been effectively denied justice because of the high cost of taking action.

The second purpose of the Bill is to deal efficiently with the situation where the damages sought by each claimant are large enough to justify individual actions and a large number of persons wish to sue the respondent. The new procedure will mean that groups of persons, whether they be shareholders or investors, or people pursuing consumer claims, will be able to obtain redress and do so more cheaply and efficiently than would be the case with individual actions.[51]

2.52 Commenting earlier this year on the 25th anniversary of the class action regime under part IVA of the Federal Court Act, Justice Bernard Murphy of the Federal Court said:

It is important to remember that before the class action regime was introduced, it was either impossible, or at least exceedingly rare for consumers, cartel victims, shareholders, investors and the victims of catastrophe to recover compensation, even when misconduct was plain.[52]

2.53 Certainly, the class action regimes in Australia have improved access to the justice system. They have created economies of scale that have made legal action financially viable to recover small losses. They have allowed costs to be spread across a large number of claimants, so that the burden on each is reduced. They have also reduced the cost burden on defendants and the pressure on court resources by avoiding numerous individual claims arising from the same or similar circumstances. Hundreds of claims can be resolved at once by settlement or judgment.[53]

2.54 It has also been observed that class actions help to overcome social and psychological factors, such as ignorance of rights or the fear of action, which can be barriers to justice because they discourage individuals from taking steps to enforce their legal rights.[54]

2.55 To gain a clearer sense of how well the objectives are being met by the Victorian class action regime, it is useful to consider more closely the number of class actions that have been filed in the Supreme Court and, for comparison and context, in the Federal Court. Professor Vince Morabito of Monash University has been compiling data about class actions, reaching back to the commencement of the Commonwealth regime in 1992, and the next section draws on some of his key findings.

Number and types of class action claims filed

Australia

2.56 The access that class actions provide to the justice system should not be overstated. They account for only about 0.1 per cent of all litigation in Australia.[55]

2.57 Although concerns were raised that it would encourage a proliferation of litigation,[56] the Commonwealth Government expected the introduction of its class action regime to generate only a ‘small number of additional cases’.[57] Over the 24 years from then to 3 March 2016, 370 class actions were filed in the Federal Court—an average of 15.4 each year.[58] Use of the class action regimes in Victoria and New South Wales has been even more modest.[59]

2.58 Table 1 is drawn from Professor Morabito’s data about the number of class actions filed, and average annual rates of filing, across the three jurisdictions until 3 March 2016. No comparative data is given on Queensland’s class action regime because it did not commence until 1 March 2017.

Table 1: Class actions filed in Australia to 3 March 2016[60]

|

Jurisdiction |

Class action regime commenced |

No of class |

Annual average to 3 March 2016 |

|

Commonwealth |

4 March 1992 |

370 |

15.4 |

|

Victoria |

1 January 2000 |

78 |

4.8 |

|

New South Wales |

4 March 2011 |

19 |

3.8 |

|

All |

– |

467 |

19.4 |

2.59 While the annual average figures provide a general sense of how many class actions have been filed, it is important to note that:

• The numbers have fluctuated from one year to the next. During the first eight years of operation of the Victorian regime, a total of 22 class actions were filed, at an average of 2.75 per year. During the next eight years, 55 were filed, at an average of 6.8 per year.

• The 467 class actions shown in Table 1 were brought with respect to a total of 303 legal disputes. Seventy (15 per cent) were competing class actions. While, nationally, an average of 19.4 class actions were filed each year over the period shown on the table, they referred to, on average, 12.6 different legal disputes.[61]

2.60 The types of claim that have been filed under the various class action regimes in Australia encompass a broad range. Justice Murphy and Professor Morabito have categorised them in the following way:[62]

• Disaster class actions. Notably for the Victorian class action regime, the six class actions on behalf of victims of the ‘Black Saturday’ bushfires in February 2009 fall within this category. The class action brought in relation to the Kilmore East–Kinglake bushfire concerned more than 10,000 claims of loss or damage, and settled after a 12-month trial for almost $500 million.[63] It is Australia’s largest-ever class action settlement. Another class action within this category concerned the two-week shut-down in the supply of gas to most of Victoria after the Longford gas plant explosion in 1998. It settled in 2004 for $32.5 million for the benefit of businesses that had suffered loss as a result of property damage or other loss related to property damage.[64]

• Claims under the Migration Act. These are claims made on behalf of asylum seekers and others in connection with the operation of Commonwealth migration law. They declined in number after October 2001, when the Migration Act 1958 (Cth) was amended to prohibit class actions relating to visas, deportations or removal of non-citizens.

• Personal injury through food, water or product contamination. These claims have also declined in number following amendments to tort law in 2002 to limit personal injury claims. A recent Victorian class action concerning soy milk, brought on behalf of 497 claimants, settled for $25 million.[65]

• Personal injury through defective products. There have been many of these, particularly regarding defective medical devices and medications. Examples of Victorian class actions in this category are those concerning travel sickness pills[66] and acne medication.[67]

• Shareholder class actions. More than 60 class actions have been brought against listed companies for misleading or deceptive conduct or for breaching continuous disclosure requirements. A major case of this type in Victoria was proceedings by shareholders of the National Australia Bank which settled for $115 million.[68]

• Investor class actions. More than 90 Commonwealth class actions have been filed on behalf of investors regarding promoters of various investments.

• Anti-cartel class actions. There have been only five class actions concerning cartel conduct, all under the Commonwealth regime.

• Consumer class actions. These have concerned misrepresentations about goods that were sold, bank fees, and claims against car manufacturers.

• Environmental class actions. Class actions in this category in Victoria include a claim by owners of property in Cranbourne whose property values were allegedly reduced by methane gas from a disused landfill. This case settled for $23.5 million.[69]

• Human rights class actions. These class actions in particular have enabled vulnerable members of the community to obtain access to justice. A recent example of a Victorian class action in this category was the claim made on of behalf of asylum seekers and refugees about the legality and conditions of their detention at the Manus Island detention centre.[70]

• Trade union class actions. Class actions within this category have concerned employment issues such as underpayment claims,[71] disputes about employer conduct in obtaining workplace agreements,[72] and orders against imminent termination of employment.[73]

• Miscellaneous. Various class actions do not fall within any of the above categories.

A Victorian example is a class action by women who were infected with Hepatitis C at a medical clinic.[74]

2.61 Based on their analysis of the cases, Justice Murphy and Professor Morabito have concluded that:

In our view, the number of claimants, the variety of their claims, and the diversity of the types of people and entities who have had access to justice through the class action procedure shows that the regime allows substantial and broad-based access to justice.[75]

Victoria

2.62 Proceedings under part 4A of the Supreme Court Act are allocated between the Common Law Division and Commercial Court.[76] The Common Law Division manages proceedings founded, or concurrently brought, in tort and in breach of contract or statute. Class actions allocated to this Division tend to fall within the disaster, environmental and personal injury categories above.

2.63 The Commercial Court hears and determines cases of a commercial nature, such as those arising out of ordinary commercial transactions, or which raise a question of importance in trade and commerce, or in which a remedy is sought under the Corporations Act 2001 (Cth) or the Australian Securities and Investments Commission Act 2001 (Cth). The class actions it manages are mainly shareholder and investor class actions.

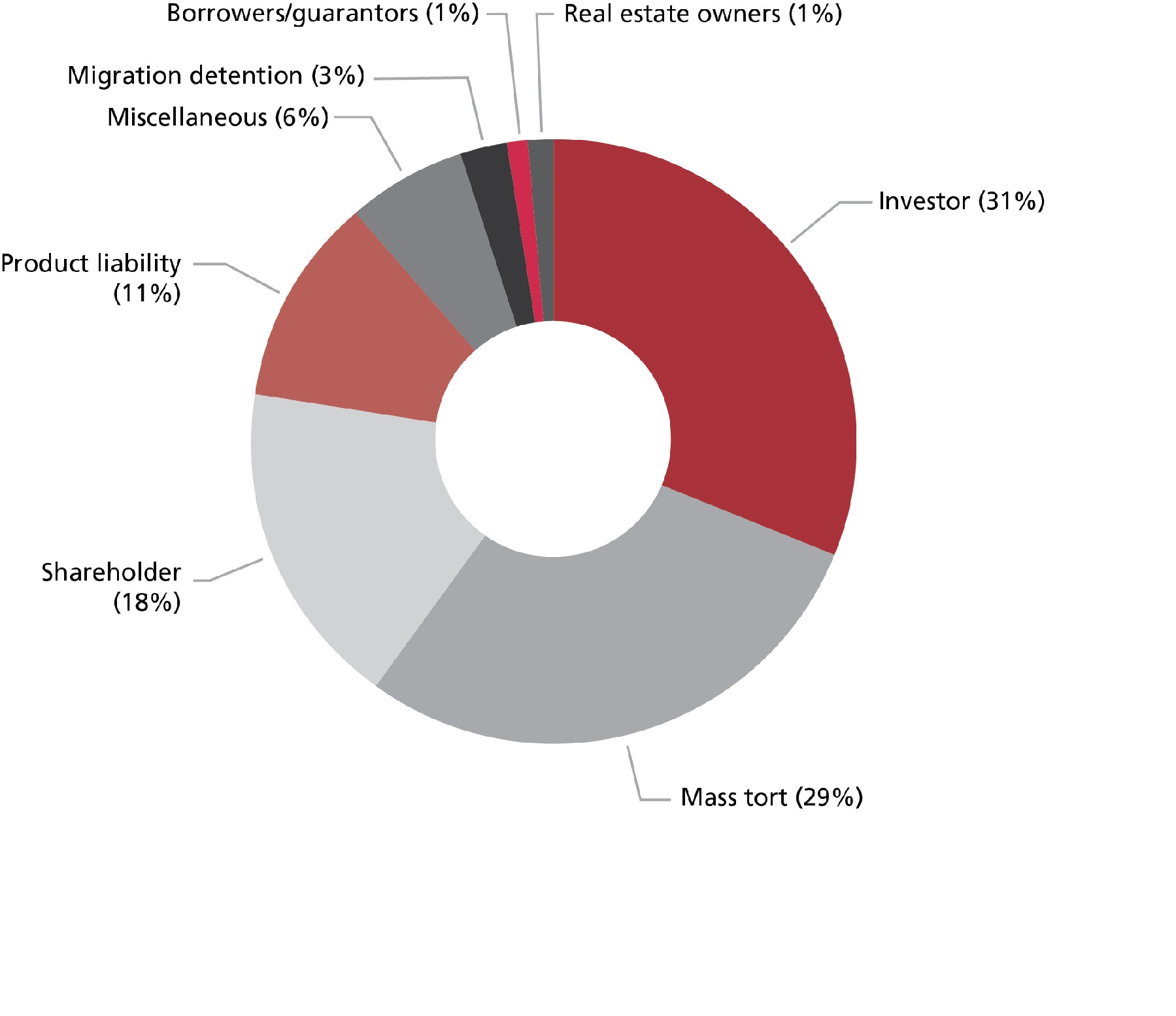

2.64 Figure 1 shows a breakdown by type of the class action proceedings filed under the Victorian regime.

Figure 1: Part 4A proceedings by type 1 January 2000–3 March 2017[77]

2.65 The total number of proceedings filed under part 4A of the Supreme Court Act, as at

3 March 2017, is 80. The number managed by each Division is similar: 41 were managed by the Common Law Division and 39 by the Commercial Court. However, the total number of disputes was 57.

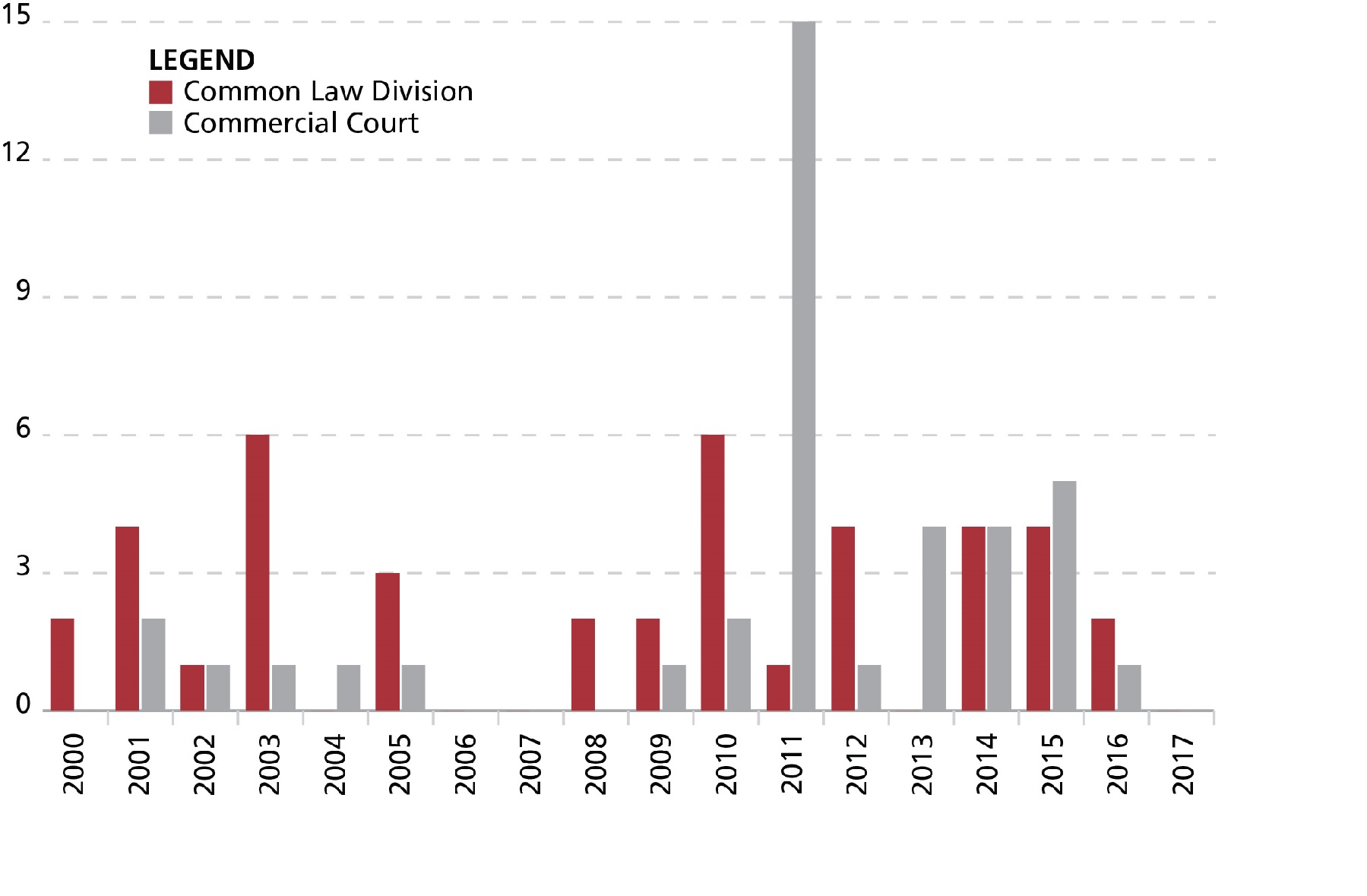

2.66 A significant contributor to the disparity between the number of disputes and number of proceedings is the legal action arising from the failure of plantations group Great Southern.[78] Sixteen separate class actions were brought on behalf of the thousands of investors affected. The resultant spike this caused in the Commercial Court’s workload can be seen in Figure 2, which shows the distribution of cases filed between January 2000 and 3 March 2017. The management of competing class actions is discussed in Chapter 7.

Figure 2: Part 4A proceedings by Supreme Court Division 1 January 2000-3 March 2017[79]

Outcomes of class actions

2.67 Sixty-five per cent of all class actions under the Victorian regime have settled. This compares favourably with the rate of 48.7 per cent for all class actions under the Commonwealth regime. However, the proportion of Commonwealth class actions that have settled has increased significantly in the past 12 years, from 39.6 per cent to 62.4 per cent. Nationally, at least $3.5 billion has been paid by defendants pursuant to judicially approved class action settlements.[80]

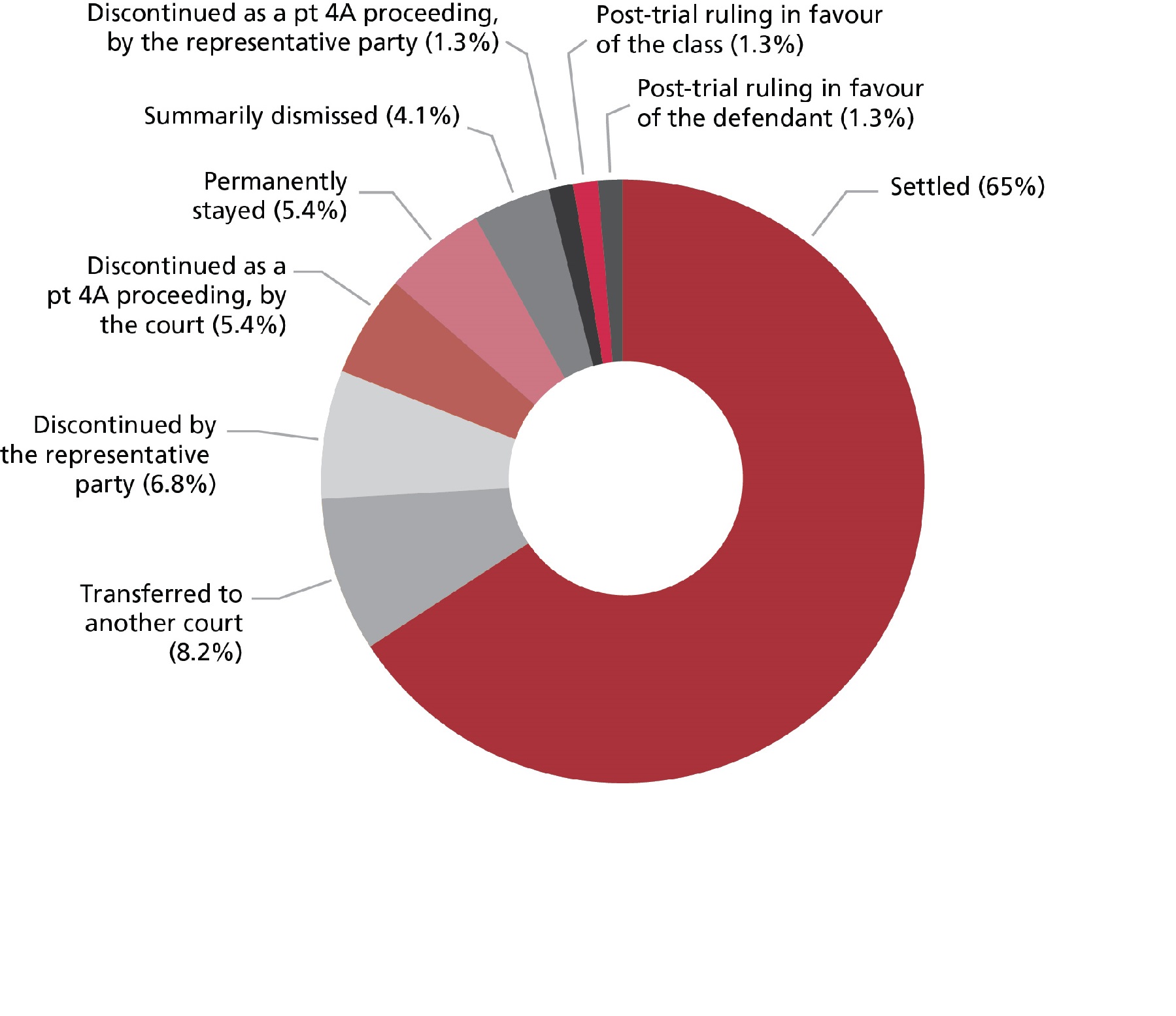

2.68 Figure 3 shows how class actions resolved under the Victorian regime. A high proportion of cases in both Divisions have settled (69 per cent in the Common Law Division, and 62 per cent in the Commercial Court). Common Law Division class actions have been discontinued by the representative plaintiff more often, and transferred to another court less frequently, than Commercial Court cases.

Figure 3: How part 4A proceedings filed since 2000 resolved as at 1 June 2017[81]

Growth in litigation funding

2.69 The beginning of the litigation funding industry in Australia coincided with the introduction of class actions. Over time, each has contributed to the development of the other. In 1988, when the Australian Law Reform Commission was preparing its recommendations for the introduction of a class action procedure, it could not have foreseen the role that litigation funders have since taken on. None of the class actions filed during the first six years of the Commonwealth regime were supported by litigation funders.

2.70 Now, litigation funders finance almost half of the proceedings filed under the Commonwealth regime (49.5 per cent). Over the period March 2010 to March 2016, 53 of the 107 class actions filed in the Commonwealth’s regime involved a litigation funder.[82]

2.71 Approximately 19 Australian and international litigation funders are active in Australia, providing a range of financial services, and the number is growing. Those which have been recognised as the most active in supporting class actions are: IMF Bentham Ltd, Comprehensive Legal Funding LLC, International Litigation Funding Partners Pte Ltd, Harbour Litigation Funding Ltd, JustKapital Litigation Partners Ltd, and BSL Litigation Partners Ltd.[83]

2.72 The top four companies were expected to account for almost 70 per cent of industry revenue in 2016–17. It was estimated that IMF Bentham Ltd alone would account for 65.8 per cent of the market, with the next largest operators accounting for less than two per cent.[84]

2.73 Industry revenue for 2016–17 was predicted to be $89.2 million, with profits of $38.5 million. Revenue has been projected to grow to $150.6 million within the next five years.[85] Most is derived from class actions, particularly shareholder class actions.[86]

Development of the market

2.74 Commercial litigation funding began as a source of finance for insolvency proceedings. It has expanded to proceedings in other areas of law that typically include:

• commercial and contractual disputes

• intellectual property

• estates

• investor, shareholder, anti-cartel and consumer protection class actions.[87]

2.75 The way in which the market has developed is unique to Australia, for a variety of reasons. The Productivity Commission has identified three factors that created a demand for litigation finance:

• the operation of the cost-shifting rule, which creates a financial risk for plaintiffs that litigation funders are able to underwrite

• the lack of after the event insurance, which in the United Kingdom provides another means of mitigating the financial risk

• the ban on lawyers being able to charge contingency fees.[88]

2.76 The ability of litigation funders to create a viable industry in response to the demand was fostered in particular by two judicial decisions:

• The 1996 Federal Court decision in Movitor Pty Ltd (rec and mgr apptd) (in liq) v Sims[89] where it was found that a third party could fund legal action by a liquidator on behalf of insolvent companies and individuals, notwithstanding the public policy against maintenance and champerty. This decision allowed commercial litigation funders to raise capital to provide funding to insolvency practitioners.[90]

• The 2006 High Court decision in Campbells Cash & Carry Pty Ltd v Fostif Pty Ltd (Fostif)[91] which upheld a third-party funding agreement that gave the litigation funder very broad powers. The Court held by majority decision that there had not been an abuse of process when a litigation funder sought out claimants to participate in representative proceedings under New South Wales Supreme Court Rules, and gave instructions for the conduct of the litigation.

2.77 The decision in Fostif provided certainty to litigation funders that they have a legitimate role in financing multi-party proceedings, including class actions. A subsequent decision by the Federal Court that class membership in class actions can be limited to those who have signed an agreement with the litigation funder[92] drove a period of significant growth in funded class actions from 2008.[93]

2.78 Another factor that may have assisted the industry to develop is the lack of regulation. The Commonwealth Government has declined to regulate the industry and has actively excluded it from regulatory requirements that apply to other financial service providers on the basis that increasing the regulatory burden on funders would raise the cost of litigation.[94] This is discussed further in Chapter 3.

2.79 Litigation funders have told the Commission that the industry is changing. Litigation funders and insurers who are based overseas have shown interest in increasing their presence in the Australian market. At the same time, there are more small local enterprises entering the market and industry employment is growing. Although class actions generate most of the revenue within the industry, not all litigation funders are involved in class actions, and they provide a variety of products. In addition, the services of litigation funders are sought by large businesses which could fund their own litigation but prefer to use a funder to manage the process.

Impact on access to justice

2.80 Litigation funding facilitates access to justice to the extent that it reduces the financial risks of taking legal action and the funder contains legal costs by supervising the process.

2.81 In large class actions, the representative plaintiff will commonly be charged around $10 million in legal costs, and risks having to pay as much, or more, to the other side if the litigation is unsuccessful. Few legal firms have the financial capacity to provide their services on a ‘no win, no fee’ basis and in any event the representative plaintiff remains directly liable for any adverse costs order.[95] Litigation funders are able to fully indemnify the representative plaintiff for their costs if they lose.

2.82 The contribution that litigation funders have made in enabling access to justice, particularly through class actions, has been recognised by government and the judiciary. In Fostif, for example, Justice Kirby observed that, if litigation funders were not permitted to finance class actions:

very many persons, with distinctly arguable legal claims, repeatedly vindicated in other like cases, [would be] unable to recover upon those claims in accordance with their legal rights.[96]

2.83 The Productivity Commission explored all sides of the debate about the role of litigation funders when reviewing access to justice arrangements. Although it called for greater regulation, it concluded that the litigation funding industry is making a valuable contribution to access to justice:

Overall, litigation funding promotes access to justice, and is particularly important in the context of class actions where, although action could create additional benefits when viewed from a broader or community-wide perspective, (often inexperienced) claimants might not take action given the scale of their personal costs and benefits.[97]

2.84 While the support given to the litigation funding industry has had positive outcomes, from a public policy perspective there are significant limitations to the extent to which access to justice is served by litigation funding. Litigation funders, as commercial operators, invest in claims that are low in risk, and they aim to maximise the returns. The cases they select are confined to distinct areas of commercial activity, and their funding fees are the largest single expense that plaintiffs pay.

Case selection

2.85 Litigation funders make commercial decisions about which claims to support. They fund claims that have strong prospects of recovering a significant financial return. Although access to justice may be provided as a result, this is not the objective of litigation funding.

2.86 Jason Betts and colleagues have identified the following criteria that, broadly, litigation funders use when deciding whether or not to fund a claim:

• the prospects of success

• the amount likely to be recovered if the claim is successful

• the costs and risks in prosecuting the claim

• the complexity of the claim

• the estimated time until the claim will be resolved

• whether there are risks in enforcing a favourable judgment, such as the solvency of a defendant.[98]

2.87 The selection process has become progressively more sophisticated. The claims must be viable, both in terms of the strength of the case and the likely return to the funder. The case must have merit and be likely to be successful. Unless the defendant has the capacity to meet any likely settlement or judgment, including the benefit of any indemnity under an insurance policy, funding is unlikely to be provided.[99] As a result, over the past 12 years, the settlement rate for Commonwealth class actions that involved a litigation funder is 92 per cent.[100]

2.88 The practice of filtering out applications for funding which do not meet stringent legal, process and commercial criteria removes claims that do not have merit (as well as those that do have merit but do not meet other criteria). For example, IMF Bentham Ltd informed the Productivity Commission that fewer than five per cent of the applications it receives are funded.[101] The diversion of unmeritorious claims allows the resources of the legal system to be allocated more efficiently.

2.89 Another outcome of the selection process is that only a narrow variety of cases are funded. Seventy-four per cent of all funded class actions filed since 1992 sought legal redress for investors and shareholders.[102]

2.90 Corporate malfeasance is a broad-based harm that affects a large number of people in similar situations, and class actions are an inherently suitable means for the victims to take legal action. Australia has robust mandatory continuous disclosure rules for ASX-listed companies, comprehensive prohibitions on misleading and deceptive conduct and a high rate of share ownership.[103] Litigation in these areas of the law presents a sound investment opportunity for litigation funders, as explained by John Walker, Suzanna Khouri and Wayne Attrill when working for IMF (Australia) Ltd in 2009:

The statutory causes of action provided in the continuous disclosure, product liability and anti-cartel legislative regimes are generally more straight-forward to establish than the equivalent actions at common law and, in the context of shareholder non-disclosure claims in particular, are determined in large part on publicly-available evidence, including documents filed with the Australian Securities Exchange.[104]

2.91 Claims aimed at obtaining non-monetary results (such as an injunction or declaration) are not funded.[105] In addition, claims for compensation for personal injury are usually unattractive to litigation funders. They rely on evidence which may give rise to a number of litigation risks and are already well supported by lawyers acting on a ‘no win, no fee’ basis.[106] As a consequence, the contribution that litigation funding makes to access to justice is limited, as Justice Ronald Sackville observed:

If the social purpose of litigation funding is to enhance access to justice for groups otherwise unable to afford litigation, it is not clear that financing only those groups with demonstrably sound cases will achieve that objective. Groups with more marginal claims must rely on other mechanisms to enforce such rights as they may have.[107]

Funded Victorian class actions

2.92 In contrast to Commonwealth class actions, almost half of which filed since 2010 received support from litigation funders,[108] only 10 of the 80 proceedings filed under part 4A of the Supreme Court Act have been funded by litigation funders.[109] This difference is a relevant factor when comparing the procedures in the Supreme Court with those in the Federal Court and considering reform options.

Costs

2.93 The terms of reference reflect concerns that the costs of funded litigation can appear excessive and not aligned to the risks to the funder or law firm, and that the fee structures for lawyers and the total amount paid to the funder of the litigation are not sufficiently transparent.

2.94 By drawing their funding fee from the amount awarded in damages or negotiated between the parties, litigation funders are well rewarded for their services. As noted above, the funding fee is usually the largest single deduction from what the claimants manage to recover in funded class actions.[110] However, it is not necessarily related to the risk, which is unlikely to be high because of the exacting process that the litigation funder follows before agreeing to provide funding.

2.95 While it may not be directly reflective of the risk undertaken, the funding fee is determined by the structure of the funding agreement, which varies in nearly every case. This was pointed out by Justice Murphy in Earglow Pty Ltd v Newcrest Mining Ltd:[111]

It should be kept in mind that it is not enough to consider the funding commission rate on a stand-alone basis. The funding arrangements reached may be structured in a variety of ways which can affect the costs and risk taken on by the funder and therefore affect the reasonableness of the funding commission rate. For example, a funder might agree:

(a) to provide funding to cover adverse costs but not to meet the applicant’s legal costs and disbursements, with the case being conducted by the applicant’s solicitors on a conditional fee basis to be paid by class members from any settlement conditional on success;

(b) to pay disbursements only, with the case being conducted by the applicant’s solicitors on a conditional fee basis;

(c) to only pay costs and disbursements up to a fixed cap or to pay a fixed percentage of the costs and disbursements, with the remainder left to the applicant’s solicitors to be paid by class members conditional on success; or

(d) to cover the risk of adverse costs liability through After the Event Insurance with the premium to be paid by class members from the settlement sum upon success.[112]

2.96 The Commission has been told that litigation funders and lawyers will sometimes voluntarily come to an arrangement to reduce their costs in order to ensure that the plaintiffs in a class action receive at least 50 per cent of the recovered amount. However, this is a commercially driven activity that need not take account of the plaintiff’s needs and, from the plaintiff’s perspective, may mean that the outcome is not fair.

2.97 Many class members have a ‘limited or non-existent’ opportunity to negotiate the funding fee;[113] others have not signed the litigation funding agreement but have a right to a share of the amount recovered. Therefore, the role of the court in supervising the settlement can be crucial to ensuring that plaintiffs are not exposed to disproportionate cost burdens. This issue is discussed in Chapter 7.

Impact on class actions

2.98 Litigation funding affects not only the number and type of class actions filed but also how class action regimes operate. A publication by Allens that looks back over the past 25 years of class actions in Australia describes class action practice today as ‘largely unrecognisable’ from its early days.[114] The reasons identified are, among other things, the acceptance of litigation funding, the emergence of shareholder class actions, and the entrepreneurial behaviour of law firms over the past 10 to 12 years.[115]

2.99 Not all of the changes, even if unpredicted when class action proceedings were first introduced, are contrary to the objectives of the legislation. The financial risk to the representative plaintiff, and to plaintiff law firms if the litigation is unsuccessful, has been identified as the reason why there was a decline in the use of the Commonwealth’s class action regime to its lowest levels in 2000–2004. By becoming involved in class actions, litigation funders revived the use of this type of proceeding.[116]

2.100 The most significant impact of litigation funding on the operation of class action regimes in Australia has been the use of closed class actions, where a class action is brought on behalf of a limited or identified number of persons, rather than all those who have suffered loss or damage as a result of the conduct of the defendant. As discussed above, the current regimes were designed for open classes, where the outcome affects all class members unless they opt out of the proceedings.

2.101 Funded proceedings that begin as open class actions rarely continue on this basis.[117] The open class system enables class members who have not entered a funding agreement with the litigation funder or a retainer with the lawyer to share in the proceeds. These class members are commonly referred to as ‘free riders’ because they do not need to contribute to the costs of the proceeding.

2.102 Closed classes provide an incentive for class members to enter the litigation funding agreement and thereby agree to contribute to the costs if the litigation is successful. Those who do not opt in to the proceedings are excluded from a share of the proceeds. The means by which the courts have protected the rights of all class members, their lawyers and the litigation funders are discussed in Chapter 7.

2.103 The use of closed classes has led to the duplication of class actions.[118] Multiple claims place additional burdens on the justice system, not only in terms of the number of claims being filed but also in the complexity of managing them, particularly when actions arising out of the same conduct are approached differently in separate proceedings.[119] It is also possible that, because the costs are shared across a smaller class, competing claims increase the costs to individual class members.

2.104 From the defendant’s viewpoint, the class members are easier to identify if the class is closed, and it is easier to calculate how much they would be liable for in damages or how much to offer in settlement. However, a major advantage of an open class is that, by determining the rights of the whole class in one proceeding, there is finality.

2.105 For these reasons, it has been observed, the efficiencies that the class action regime was intended to provide are weakened.[120]

Entrepreneurialism in legal services

2.106 In the period over which class action regimes have been established in Australia, and third-party commercial litigation funding has become an accepted feature of our legal system, the legal profession has undergone comprehensive regulatory reform and become more commercially oriented.

2.107 Rules governing the structure of legal firms were liberalised, and legal services were made more accessible and affordable through innovative fee structures and technology. Greater competition and efficiency are associated with a focus on generating new business, improving consumer satisfaction and maximising returns.[121]

2.108 The increase in entrepreneurialism within the legal profession is likely to have fostered the growth of the litigation funding industry. Ben Slade, State Managing Principal of Maurice Blackburn, has commented on the importance of litigation funders to enabling that law firm to take on large cases:

It took us about 10 years to accept that we had to meet the defendant’s resources if we were going to succeed. Litigation funding has helped enormously because taking on the cashflow impact of a litigation is frightening.[122]

Impact on access to justice

2.109 Entrepreneurialism and collaboration with litigation funders have had a positive effect on access to justice, to the extent that they have provided individuals who otherwise would have been unable to enforce their rights the opportunity to do so.

2.110 Two law firms, Maurice Blackburn and Slater and Gordon, account for a third of all class actions brought under part IVA of the Federal Court Act. As at 3 March 2016, each had brought 64 class actions within that jurisdiction.[123] While many of these cases were financed by litigation funders, these two firms have the capacity to conduct class actions without them on a ‘no win, no fee’ basis.

2.111 Professor Morabito has pointed out that these firms, and several others that are willing to act on a ‘no win, no fee’ basis, have run class actions on social justice issues for clients other than shareholders and investors. In doing so, they have enabled many vulnerable individuals to use the class action regime to enforce their rights.[124]

2.112 In an article written in collaboration with Jarrah Ekstein, an Associate in the class actions team at Maurice Blackburn, Professor Morabito has analysed 87 class actions filed in Australia for the benefit of vulnerable people between March 1992 and March 2014.[125] None involved litigation funders. Among the claimants who have been assisted are:

• Indigenous people

• refugees and migrants[126]

• individuals with intellectual disabilities

• individuals who, as children, suffered systematic abuse at a residential institution or were wrongfully arrested and detained

• participants in a government home finance scheme

• short term credit customers

• residents of a retirement village

• residents of isolated villages in Papua New Guinea who were affected by pollution from copper mining

• victims of tobacco-related diseases, harmful prescribed drugs, faulty medical devices, bushfires, medical negligence, legionnaires disease, harmful food and beverages and the collapse of the chairlift at Arthurs Seat.

Impact on class actions

2.113 Commercialisation has prompted concerns about the impact of economic imperatives on the selection of class action cases. At the core of the concerns is the belief that claims are being generated at the initiative of the law firms, rather than in response to instructions from clients. It has been suggested that claims are being made that do not appear to have been brought for the primary purpose of seeking a substantive remedy for class members.[127]

2.114 The fact that a class action has been initiated by a law firm is not reason alone to suggest that interests of the class members are not given priority. In many of the class actions filed on behalf of vulnerable people, the law firm has expended considerable time and resources to assist the class members to overcome socio-economic, health, age-related and intellectual barriers in order to enforce their rights. This has required the lawyers involved to actively seek out and advise class members, taking additional steps that would not be necessary in other cases.[128] Although their costs, plus an uplift, are paid if the class action is successful, the risks are higher and the success rate lower compared to shareholder and investor class actions.

2.115 The number of class actions being filed by smaller plaintiff law firms is increasing, and this may indicate greater entrepreneurialism within the profession. Social media has made it easier to build a class, and technology has made it easier to share information about, and copy, class action claims that have been litigated in the United States.[129]

2.116 Allens has noted that, since 2013, 26 per cent of class actions were filed by 29 firms. Each filed either one or two claims. Nine firms, including Maurice Blackburn and Slater and Gordon, accounted for the remaining 74 per cent. The increase in the number of law firms bringing class actions has been associated with more speculative claims being filed.[130]

2.117 The increase in competing class actions has also been attributed to legal entrepreneurialism. Allens has observed that, although the number of filings has increased since 2005, the number of companies facing class actions has fallen. Of these companies, an increasing number face more than one class action in relation to the same conduct.[131] As noted above, competing class actions reduce the efficiency of the legal system and expose the defendant to the cost and uncertainty of responding to multiple actions.

2.118 Finally, there are serious concerns about the conflicts of interest that arise for lawyers in class actions, particularly when a litigation funder is involved.[132] This issue is discussed in Chapter 3.

-

See, eg, Productivity Commission, Access to Justice Arrangements, Inquiry Report No 72 (2014) vol 2, 601–37.

-

The principle applies generally, and not just in litigation, but there are several exceptions. In matters heard by administrative tribunals and in some areas of law, eg family, employment and criminal law, the parties to proceedings usually cover their own costs.

-

Supreme Court (General Civil Procedure) Rules 2015 (Vic) O 62.

-

Productivity Commission, Access to Justice Arrangements, Inquiry Report No 72 (2014) vol 2, 612.

-

Ibid 20.

-

Ibid 622.

-

Standing Committee of Attorneys-General, Litigation Funding in Australia, Discussion Paper (2006) 4.

-

Simone Degeling and Michael Legg, ‘Fiduciaries and Funders: Litigation Funders in Australian Class Actions’ (2017) 36 Civil Justice Quarterly 244, 246–9.

-

Ibid.

-

Currently permitted by Legal Profession Uniform Law Application Act 2014 (Vic) sch 1 (‘Legal Profession Uniform Law’) s 181.

-

Ibid sch 1 Legal Profession Uniform Law s 182.

-

Productivity Commission, Access to Justice Arrangements, Inquiry Report No 72 (2014) vol 2, 603.

-

Ibid 605. The Productivity Commission concluded that there needs to be better oversight to ensure that lawyers do not charge the full 25% when this is not warranted: 625.

-

IMF Bentham Ltd, Funding for Insolvency and Restructuring Professionals (2017) <www.imf.com.au/practice-areas/funding-for-insolvency>.

-

Legal Profession Uniform Law Application Act 2014 (Vic) sch 1 (‘Legal Profession Uniform Law’) ss 181–2.

-

Rebecca LeBherz and Justin McDonnell, ATE Insurance and Implications for Class Actions in Australia (30 September 2014) King & Wood Mallesons <www.kwm.com/en/au/knowledge/insights/ate-insurance-and-implications-for-class-actions-in-australia-20140930>.

-

Ibid.

-

The Supreme Court in Australian Property Custodian Holdings Ltd (in liq) v Pitcher Partners [2015] VSC 513 (24 September 2015) approved a deed of indemnity offered by a foreign insurer as security for a defendant’s adverse costs in litigation.

-

Premiums were made recoverable in 1999, which led to significant increases in both the number of providers and the size of the premiums. Since 2013, premiums are recoverable only in certain limited circumstances: Rebecca LeBherz and Justin McDonnell, ATE Insurance and Implications for Class Actions in Australia (30 September 2014) King & Wood Mallesons <www.kwm.com/en/au/knowledge/insights/ate-insurance-and-implications-for-class-actions-in-australia-20140930>.

-

See, eg, National Insurance Brokers Association, Australians Can Now Insure Themselves Against Loss at Trial (25 October 2016) Insurance

& Risk </www.insuranceandrisk.com.au/australian-can-now-insure-themselves-against-loss-at-trial/>.

-

Legal Profession Uniform Law Application Act 2014 (Vic) sch 1 (‘Legal Profession Uniform Law’) s 183.

-

Law Commission, Proposals for Reform of the Law Relating to Maintenance and Champerty, Report No 7 (1966) vol 1, [9] cited in G E Dal Pont, Law of Costs (LexisNexis Butterworths, 3rd ed, 2013) 58.

-

Ellis v Torrington (1920) 1 KB 399, 412 cited in G E Dal Pont, Law of Costs (LexisNexis Butterworths, 3rd ed, 2013) 58.

-

For Victoria, see Abolition of Obsolete Offences Act 1969 (Vic) ss 2, 4. See also the High Court decision in Campbells Cash & Carry Pty Ltd v Fostif Pty Ltd (2006) 229 CLR 386.

-

Productivity Commission, Access to Justice Arrangements, Inquiry Report No 72 (2014) vol 2, 601.

-

On 1 February 1977 the Attorney-General referred the issue to the Australian Law Reform Commission to report on the adequacy of existing law relating to class actions and included the question on contingency fees. See Law Reform Commission, Grouped Proceedings in the Federal Court, Report No 46 (1988).

-

Law Institute of Victoria, Funding Litigation—The Contingency Fee Option (1988). See also Law Institute of Victoria, Percentage-Based Contingency Fees, Position Paper (17 February 2016).

-

Michael McGarvie, Victorian Legal Services Commissioner, Opinion: Contingency Fees Will Fail Us (Media Release, 3 March 2016)

<www.lsbc.vic.gov.au/documents/Opinion-Contingency_fees_will_fail_us-2016.pdf>.

-

The Victorian Bar, Percentage Based Contingency Fee Agreements, Position Paper (11 November 2015).

-

The Commission has been informed that, in May 2014, the Law Council of Australia Working Group on Contingency Fees was asked to explore the issues of contingency fee agreements and recommended lifting the ban. In April 2016, after reviewing the arguments for and against, the Directors of the Law Council decided not to accept the Working Group’s recommendations.

-

Commonwealth reports include: Law Reform Commission, Grouped Proceedings in the Federal Court, Report No 46 (1988); Access to Justice Advisory Committee, Access to Justice an Action Plan (1994); Law Reform Commission, Costs Shifting—Who Pays for Litigation, Report No 75 (1995); and Managing Justice—A Review of the Federal Civil Justice System, Report No 89 (2000); Productivity Commission, Access to Justice Arrangements, Inquiry Report No 72 (2014). In Victoria: Law Reform Commission of Victoria, Restrictions on Legal Practice, Discussion Paper No 23 (1991); Law Reform Commission of Victoria, Access to the Law: Restrictions on Legal Practice, Report No 47 (1992); Victorian Law Reform Commission, Civil Justice Review, Report No 14 (2008).

-

Commonwealth, Parliamentary Debates, House of Representatives, 14 November 1991, 3174 (Michael Duffy, Attorney-General); Bernard Murphy and Camille Cameron, ‘Access to Justice and the Evolution of Class Action Litigation in Australia’ (2006) 30 Melbourne University Law Review 399, 401.

-

Civil Procedure Act 2005 (NSW) pt 10. It commenced on 4 March 2011.

-

Civil Proceedings Act 2011 (Qld) pt 13A. The new class action regime commenced on 1 March 2017.

-

In 2015, the previous Western Australian Government had supported in principle the Law Reform Commission of Western Australia’s recommendation that a class action regime be established: Western Australia, Parliamentary Debates, Legislative Council, 21 October 2015, 7558b (Michael Mischin, Attorney-General). The current Government’s platform included a commitment to introduce class actions: WA Labor, Comprehensive Evidence-Based Approach to Reduce Crime and Protect Victims (6 January 2017) <www.markmcgowan.com.au/news/comprehensive-evidence-based-approach-to-reduce-crime-and-protect-victims-1276>. See also Law Reform Commission of Western Australia, Representative Proceedings, Final Report Project 103 (2015).

-

Supreme Court of Victoria, Practice Note SC Gen 10—Conduct of Group Proceedings (Class Actions), 30 January 2017.

-

Supreme Court Act 1986 (Vic) s 33C(1).

-

The term used in the legislation is ‘plaintiff’: Supreme Court Act 1986 (Vic) s 33A (definition of ‘plaintiff’). The term ‘representative plaintiff’ is used in this paper to distinguish between the plaintiff in class actions, who is representing the class, and the plaintiff in ordinary litigation.

-

Supreme Court Act 1986 (Vic) s 33ZD; Federal Court of Australia Act 1976 (Cth) s 43(1A). Class members who seek a determination of a question as a representative of a sub-group or individually may be liable for costs: Supreme Court Act 1986 (Vic) ss 33Q, 33R.

-

Supreme Court Act 1986 (Vic) s 33E.

-

Ibid s 33ZB.

-

Law Reform Commission, Grouped Proceedings in the Federal Court, Report No 46 (1988) 49.

-

Supreme Court Act 1986 (Vic) ss 33M, 33N(1).

-

Ibid s 33ZF.

-

Justice Bernard Murphy and Vince Morabito, ‘The First 25 Years: Has the Class Action Regime Hit the Mark on Access to Justice?’ in Damian Grave and Helen Mould (eds), 25 Years of Class Actions in Australia: 1992–2017 (Ross Parsons Centre of Commercial, Corporate and Taxation Law, 2017) 13, 32–7.

-

Supreme Court Act 1986 (Vic) s 33V.

-

Data provided by Vince Morabito, 2 June 2017.

-

Supreme Court Act 1986 (Vic) s 33V.

-

Ibid s 33X(4).

-

Supreme Court of Victoria, Practice Note SC Gen 10—Conduct of Group Proceedings (Class Actions), 30 January 2017 [13]. As to whether the terms of the settlement are fair, the Court relies on the plaintiff’s lawyers to ensure that it has evidence addressing the requirements in the practice note. In Pathway Investments Pty Ltd v National Australia Bank Ltd (No 3) [2012] VSC 625 (19 December 2012), the Supreme Court expressed a preference for an opinion, akin to that of an expert witness, which candidly evaluated the strengths and weaknesses of a party’s case over submissions on the settlement from the lawyer: see Michael Legg, ‘Class Action Settlements in Australia—The Need for Greater Scrutiny’ (2014) 38 Melbourne University Law Review 590, 599.

-

Commonwealth, Parliamentary Debates, House of Representatives, 14 November 1991, 3174 (Michael Duffy, Attorney-General).

-

Sarah Danckert, ‘We Should Worry About Corporate Wrongs, Not Class Actions: Judge’, The Age (Melbourne), 22 March 2017.

-

Michael Legg, ‘ADR and Class Actions Compared’ in Michael Legg (ed), The Future of Dispute Resolution (LexisNexis Butterworths, 2012) 180, 187.

-

Ben Phi and Odette Phi, ‘Arming the Courts in Collective Redress—A Move to “Australian-Style” Class Actions in the UK?’ (2017) 36

Civil Justice Quarterly 197, 199.

-

Maurice Blackburn, ‘Class Action Myths Exposed: Productivity Commission Submission’ (Media Statement, 15 November 2013)

<www.mauriceblackburn.com.au/about/media-centre/media-statements/2013/ >.

-

Commonwealth, Parliamentary Debates, House of Representatives, 26 November 1991, 3284 (Peter Costello).

-

Commonwealth, Parliamentary Debates, House of Representatives, 14 November 1991, 3174 (Michael Duffy, Attorney-General).

-

Vince Morabito, An Empirical Study of Australia’s Class Action Regimes, Fourth Report: Facts and Figures on Twenty-Four Years of Class Actions in Australia (29 July 2016), 2 <https://ssrn.com/abstract=2815777>.

-

Vince Morabito, ‘Empirical Perspectives on 25 Years of Class Actions’ in Damian Grave and Helen Mould (eds), 25 Years of Class Actions in Australia: 1992–2017 (Ross Parsons Centre of Commercial, Corporate and Taxation Law, 2017) 43, 45.

-

Data drawn from Vince Morabito, An Empirical Study of Australia’s Class Action Regimes, Fourth Report: Facts and Figures on Twenty-Four Years of Class Actions in Australia (29 July 2016) <https://ssrn.com/abstract=2815777>.

-

Ibid.

-

Justice Bernard Murphy and Vince Morabito, ‘The First 25 Years: Has the Class Action Regime Hit the Mark on Access to Justice?’ in Damian Grave and Helen Mould (eds), 25 Years of Class Actions in Australia: 1992–2017 (Ross Parsons Centre of Commercial, Corporate and Taxation Law, 2017) 13, 22–8.

-

Matthews v AusNet Electricity Services Pty Ltd [2014] VSC 663 (23 December 2014).

-

Johnson Tiles Pty Ltd v Esso Australia Pty Ltd (No 4) [2004] VSC 466 (8 November 2004).

-

Downie v Spiral Foods Pty Ltd [2015] VSC 190 (7 May 2015) [7]. After providing for the costs of the proceedings and for the administration of the settlement, about $16.5 million was available for distribution among the class members.

-

Reynolds v Key Pharmaceuticals Pty Ltd (unreported, Supreme Court of Victoria, No 5621 of 2002).

-

Vlamas v Roche Products Pty Ltd (unreported, Supreme Court of Victoria, No 8045 of 2012).

-

Pathway Investments Pty Ltd v National Australia Bank Ltd (No 3) [2012] VSC 625 (19 December 2012). Legal and other costs, and the litigation funder’s commission, had to be deducted from this amount before distribution of the balance to class members.

-

Wheelahan v City of Casey [2011] VSC 215 (23 May 2011). Of the settlement amount, $17.25 million was allocated to the compensation of class members.

-

Kamasaee v Commonwealth of Australia (No 2) (LPP Ruling) [2016] VSC 404 (20 July 2016) [1].

-

Construction, Forestry, Mining and Energy Union v Contract Blinds Pty Ltd [2009] FCA 572 (28 May 2009).

-

Smith v University of Ballarat (2006) 229 ALR 343.

-

Patrick Stevedores No 2 Pty Ltd v Maritime Union of Australia (1998) 195 CLR 1.

-

A v Peters [2011] VSC 478 (23 September 2011).

-

Justice Bernard Murphy and Vince Morabito, ‘The First 25 Years: Has the Class Action Regime Hit the Mark on Access to Justice?’ in Damian Grave and Helen Mould (eds), 25 Years of Class Actions in Australia: 1992–2017 (Ross Parsons Centre of Commercial, Corporate and Taxation Law, 2017) 13, 28.

-

For a full explanation of the allocation of proceedings between the two divisions, see Supreme Court of Victoria, Practice Note SC Gen 2—Structure of the Trial Division, 30 January 2017.

-

Data provided by Vince Morabito, 2 June 2017 and 27 June 2017. ‘Mass torts’ includes the disaster class actions, and the Cranbourne landfill and Hepatitus C class actions, mentioned in [2.60]. ‘Product liability’ encompasses the two ‘personal injury’ categories mentioned in [2.60]. ‘Migration detention’ includes the Manus Island class action mentioned in [2.60].

-

Clarke v Great Southern Finance Pty Ltd (in liq) [2014] VSC 516 (11 December 2014).

-

Data drawn from Vince Morabito, An Empirical Study of Australia’s Class Action Regimes, Fourth Report: Facts and Figures on Twenty-Four Years of Class Actions in Australia (29 July 2016) <https://ssrn.com/abstract=2815777>.

-

Data provided by Vince Morabito, 2 June 2017.

-

Data provided by Vince Morabito, 2 June 2017.

-

Vince Morabito, An Empirical Study of Australia’s Class Action Regimes, Fourth Report: Facts and Figures on Twenty-Four Years of Class Actions in Australia (29 July 2016) <https://ssrn.com/abstract=2815777>.

-

Jason Betts, David Taylor and Christine Tran, ‘Litigation Funding for Class Actions’ in Damian Grave and Helen Mould (eds), 25 Years of Class Actions in Australia: 1992–2017 (Ross Parsons Centre of Commercial, Corporate and Taxation Law, 2017) 205, 208.

-

Patrick Windle, Litigation Funding in Australia—IBIS World Industry Report OD5446 (February 2017) IBISWorld, 17 <www.ibisworld.com.au/industry-trends/specialised-market-research-reports/advisory-financial-services/litigation-funding.html>.

-

Ibid 4.

-

Ibid 13.

-

Wayne J Attrill, ‘The Future of Litigation Funding in Australia’ in Michael Legg (ed), The Future of Dispute Resolution (LexisNexis Butterworths, 2012) 167, 169.

-

Productivity Commission, Access to Justice Arrangements, Inquiry Report No 72 (2014) vol 2, 608.

-

(1996) 54 FCR 380.

-

Susanna Khouri, Wayne Attrill and Clive Bowman, ‘Litigation Funding and Class Actions—Idealism, Pragmatism and a New Paradigm’ in Damian Grave and Helen Mould (eds), 25 Years of Class Actions in Australia: 1992–2017 (Ross Parsons Centre of Commercial, Corporate and Taxation Law, 2017) 229, 235.

-

(2006) 229 CLR 386.

-

Multiplex Funds Management Ltd v P Dawson Nominees Pty Ltd (2007) 164 FCR 275.

-

Jason Betts, David Taylor and Christine Tran, ‘Litigation Funding for Class Actions’ in Damian Grave and Helen Mould (eds), 25 Years of Class Actions in Australia: 1992–2017 (Ross Parsons Centre of Commercial, Corporate and Taxation Law, 2017) 205, 207.

-

The Treasury, Australia, Post-Implementation Review—Litigation Funding—Corporations Amendment Regulations 2012 (No 6) (October 2015) <http://ris.pmc.gov.au/2016/03/15/litigation-funding>.

-

Justice Bernard Murphy and Vince Morabito, ‘The First 25 Years: Has the Class Action Regime Hit the Mark on Access to Justice?’ in Damian Grave and Helen Mould (eds), 25 Years of Class Actions in Australia: 1992–2017 (Ross Parsons Centre of Commercial, Corporate and Taxation Law, 2017) 13, 28. Non-representative class members are statutorily immune from costs ordered against the representative plaintiff.

-

Campbells Cash & Carry Pty Ltd v Fostif Pty Ltd (2006) 229 CLR 386, 442 (Kirby J).

-

Productivity Commission, Access to Justice Arrangements, Inquiry Report No 72 (2014) vol 2, 624.

-

Jason Betts, David Taylor and Christine Tran, ‘Litigation Funding for Class Actions’ in Damian Grave and Helen Mould (eds), 25 Years of Class Actions in Australia: 1992–2017 (Ross Parsons Centre of Commercial, Corporate and Taxation Law, 2017) 205, 209.

-

John Walker, Susanna Khouri and Wayne Attrill, ‘Funding Criteria for Class Actions’ (2009) 32 University of New South Wales Law Journal 1036, 1043.

-

Vince Morabito, An Empirical Study of Australia’s Class Action Regimes, Fourth Report: Facts and Figures on Twenty-Four Years of Class Actions in Australia (29 July 2016), 13 <https://ssrn.com/abstract=2815777>.

-

Productivity Commission, Access to Justice Arrangements, Inquiry Report No 72 (2014) vol 2, 619.

-

Vince Morabito, ‘Empirical Perspectives on 25 Years of Class Actions’ in Damian Grave and Helen Mould (eds), 25 Years of Class Actions in Australia: 1992–2017 (Ross Parsons Centre of Commercial, Corporate and Taxation Law, 2017) 43, 48.

-

Jason Betts, David Taylor and Christine Tran, ‘Litigation Funding for Class Actions’ in Damian Grave and Helen Mould (eds), 25 Years of Class Actions in Australia: 1992–2017 (Ross Parsons Centre of Commercial, Corporate and Taxation Law, 2017) 205, 207.

-

John Walker, Susanna Khouri and Wayne Attrill, ‘Funding Criteria for Class Actions’ (2009) 32 University of New South Wales Law Journal 1036, 1042.

-

Ibid 1041.

-

Ibid 1047.

-

R Sackville, ‘Lawyers and Litigation: A Pathway Out to Wealth and Gain?’ in Michael Legg (ed), The Future of Dispute Resolution (LexisNexis Butterworths, 2012) 191, 197.

-

Vince Morabito, An Empirical Study of Australia’s Class Action Regimes, Fourth Report: Facts and Figures on Twenty-Four Years of Class Actions in Australia (29 July 2016), 8 <https://ssrn.com/abstract=2815777>.

-

Data provided by Vince Morabito, 2 June 2017.

-

Money Max Int Pty Ltd v QBE Insurance Group Ltd (2016) 245 FCR 191, 208 [72].

-

[2016] FCA 1433 (28 November 2016).

-

Ibid [179].

-

Money Max Int Pty Ltd v QBE Insurance Group Ltd (2016) 245 FCR 191, 208 [72].

-

Allens Linklaters, 25 Years of Class Actions: Where are we up to and where are we headed? <www.allens.com.au/services/class/index.htm>.

-

Ibid.

-

Justice Bernard Murphy and Vince Morabito, ‘The First 25 Years: Has the Class Action Regime Hit the Mark on Access to Justice?’ in Damian Grave and Helen Mould (eds), 25 Years of Class Actions in Australia: 1992–2017 (Ross Parsons Centre of Commercial, Corporate and Taxation Law, 2017) 13, 29. In designing the model on which the legislation is based, the ALRC recognised that a mechanism was needed to reduce the representative plaintiff’s risk of having to pay all or most of the other side’s legal costs if the litigation is unsuccessful. Its recommendation that government create a public fund for this purpose was not accepted: Murray Wilcox, ‘Class Actions in Australia: Recollections of the Early Days’ in Damian Grave and Helen Mould (eds), 25 Years of Class Actions in Australia: 1992–2017 (Ross Parsons Centre of Commercial, Corporate and Taxation Law, 2017) 5, 7.

-

Money Max Int Pty Ltd v QBE Insurance Group Ltd (2016) 245 FCR 191, 228 [188].

-

For statistical information about competing class actions, see [2.59] above.

-

Allens Linklaters, 25 Years of Class Actions: Where are we up to and where are we headed? <www.allens.com.au/services/class/index.htm>.

-

Ibid.

-

R Sackville, ‘Lawyers and Litigation: A Pathway Out to Wealth and Gain?’ in Michael Legg (ed), The Future of Dispute Resolution (LexisNexis Butterworths, 2012) 191, 196.

-

Misa Han, ‘Defence Domination of Category Criticised’, Australian Financial Review (Sydney) 7 April 2017, 34.

-