Access to Justice—Litigation Funding and Group Proceedings: Consultation Paper

3. Current regulation of litigation funders and lawyers

Introduction

3.1 Litigation funders and lawyers play a crucial role in providing access to justice. They enable their clients to have access to the legal system and control how they interact with legal processes. Clients entrust them with the conduct of the litigation, sometimes for a considerable fee, in the expectation that they will work to obtain the best possible outcome. Those clients whose interests are not given priority by the litigation funder or lawyer are more likely to be exposed to unfair risks and disproportionate cost burdens.

3.2 Some of the regulatory controls that protect the interests of the clients of litigation funders and lawyers align with obligations that arise from a fiduciary relationship. A fiduciary relationship is one of trust and confidence, where one person (the fiduciary) exercises a discretion on behalf of another person that ‘will affect the interests of that other person in a legal or practical sense’.[1]

3.3 The relationship between lawyers and their clients has long been recognised as a fiduciary relationship. Litigation funders can also have fiduciary obligations to their clients in some circumstances. Simone Degeling and Michael Legg have argued that, in class actions, the fiduciary obligations of litigation funders and lawyers can extend beyond their clients to all class members.[2]

3.4 The obligations that arise from a fiduciary relationship include, among other things, an obligation to act honestly and in the client’s best interests and to avoid conflicts of interest. A fiduciary must not promote their personal interests where they conflict, or where there is a real or substantial possibility that they will conflict, with the interests of the person to whom the obligation is owed, unless they have that person’s informed consent.[3] The person can give informed consent only if they know about the actual or potential conflict and understand the consequences of consenting.

3.5 Some of the possible reforms set out in the terms of reference are directed towards improving the disclosure of information by litigation funders and lawyers to clients and the court, and ensuring that they do not take a disproportionate share of any settlement or award of damages. As such, they would reinforce the fiduciary obligation to avoid conflicts of interest. These possible reforms are discussed in Chapters 4, 5 and 7.

3.6 This chapter discusses how the conduct of litigation funders and lawyers is directly regulated by a framework of laws and rules. The framework can be viewed from two perspectives: the systemic regulation of the litigation funding industry and legal profession; and the case-by-case regulation of participants in court proceedings.

3.7 The terms of reference focus on the latter. Victoria has limited scope to directly regulate the litigation funding industry and the legal profession. The Commonwealth regulates financial services and products, and the legal profession in Victoria and New South Wales is regulated under uniform law that affects the ability of each state to act unilaterally.

3.8 However, in considering the regulation of proceedings under Victorian legislation and in Victorian courts, as required by the terms of reference, it is necessary to understand the broader regulatory context in which litigation funders and lawyers operate.

3.9 For this reason, the next section provides an overview of the regulation of the litigation funding industry and legal profession. It is followed by a discussion of how the activities of litigation funders and lawyers are supervised and regulated in court proceedings. The final section describes the tripartite relationship between the litigation funder, lawyer and plaintiff in class actions and the conflicts of interest that can arise.

General regulation

Litigation funders

Corporations Act 2001 (Cth)

3.10 All incorporated litigation funders are regulated by the Corporations Act 2001 (Cth) on the same basis as other corporations. Those that are listed on the Australian Securities Exchange (ASX) are also contractually bound to the ASX to comply with Listing Rules that are enforceable under the Corporations Act.[4]

3.11 These legal obligations protect the interests of shareholders rather than clients.

Corporations Regulations 2001 (Cth)

3.12 The Corporations Act requires providers of financial products generally to hold an Australian Financial Services Licence (AFSL).[5] The Corporations Regulations 2001 (Cth) specify that litigation funding schemes and arrangements are financial products but the providers are exempt from the requirement to hold an AFSL as long as they have appropriate processes in place to manage conflicts of interest.[6]

3.13 The exemption was made in response to a series of court decisions about whether the activities of litigation funders fell within the scope of the Corporations Act.

3.14 In October 2009, the Federal Court had found that the funding arrangements in a shareholder class action constituted a managed investment scheme that was required to be registered under section 9 of the Corporations Act.[7] This decision was followed in March 2011 by a decision of the New South Wales Court of Appeal that, as litigation funding could be used to manage financial risk, it was a ‘financial product’ and required the litigation funder to hold an AFSL.[8] The High Court found on appeal that litigation funders were ‘credit facilities’ rather than ‘financial products’. As such, litigation funders were not required to hold an AFSL, but rather, could be regulated under the National Consumer Credit Protection Act 2009 (Cth).[9]

3.15 The Commonwealth Government considered that class actions were already subject to sufficient regulation, and that reducing the regulatory costs for litigation funders would ensure greater access to justice for consumers.[10] The post-implementation review of the Corporations Amendment Regulation that created the exemption stated that:

If not addressed, these decisions would have imposed a considerable additional regulatory burden on litigation funders, in turn raising the cost for consumers of pursuing court proceedings and potentially reducing their capacity to seek justice.[11]

3.16 In exchange for relief from the need to hold an AFSL, litigation funders are required to maintain adequate conflict of interest practices.[12] Failure to do so and follow certain procedures for managing conflicts is an offence.[13]

3.17 The Corporation Regulations stipulate that having adequate practices for managing a conflict of interest includes reviewing the terms of the funding agreement to ensure that they are consistent with Division 2 of Part 2 of the Australian Securities and Investments Commission Act 2001 (Cth) (the ASIC Act).[14] These provisions set out the law regarding unconscionable conduct and consumer protection in relation to financial services and are discussed below.

3.18 ASIC has supplemented the Corporations Regulations with a regulatory guide to the processes that a litigation funder must implement in order to prevent conflicts of interest.[15]

Australian Securities and Investments Commission Act 2001 (Cth)

3.19 Litigation funders, as providers of financial services and products, are directly subject to the consumer protections in the ASIC Act[16] (and are required to ensure that the terms of their funding agreements are consistent with them).

3.20 Division 2 of Part 2 of the ASIC Act contains protections against unfair contract terms,[17] unconscionable conduct,[18] and misleading and deceptive conduct.[19] It also provides for an implied warranty in financial services contracts that the services will be rendered with due care and skill.[20]

3.21 These provisions address the risks of an unscrupulous litigation funder imposing unfair or extortionate terms in funding agreements, misleading clients about the advantages and disadvantages of litigation or failing to disclose all relevant aspects of the agreement.[21]

Reform proposals for the Commonwealth

3.22 In summary, a litigation funder operating in Australia is free from mandatory licensing, financial disclosure requirements, reporting obligations and prudential supervision, unless the choice is made to list on the ASX or hold an AFSL.[22]

3.23 The Productivity Commission recently called for litigation funders to be licensed to ensure they hold adequate capital to manage their financial obligations.[23] This is seen as a way to protect plaintiffs and defendants from an impecunious litigation funder by ensuring that the funder has adequate capital and liquidity to meet its obligations under the litigation funding agreement.

3.24 The Productivity Commission examined the self-regulatory approach maintained in England and Wales. There, litigation funders are subject to capital adequacy requirements (currently a minimum of £5 million). The self-regulatory regime also requires funders to:

• maintain access to the minimum capital required

• accept a continuous disclosure obligation in relation to capital adequacy

• arrange annual auditing

• provide the regulatory body with reasonable evidence that the funder satisfies the minimal capital requirement prevailing at the time of the annual subscription.[24]

3.25 The Productivity Commission considered that the potential barriers to entry created through licensing requirements were justified in order to ensure that only ‘reputable and capable funders enter the market’.[25] It noted that any form of regulation would only act to reduce rather than eliminate financial risk.[26]

Lawyers

Uniform Law

3.26 Compared to litigation funders, the legal profession is subject to considerable regulation. In Victoria, the principal legislation is The Legal Profession Uniform Law Application Act 2014 (Vic) (Uniform Law Application Act) which contains at schedule 1 the Legal Profession Uniform Law (the Uniform Law). It is supplemented by Legal Profession Uniform General Rules made by the Legal Services Council. Lawyers in Victoria and New South Wales are subject to the same regulatory framework.

3.27 The Uniform Law sets out principles of professional conduct established by the common law, and specific obligations for lawyers in conducting the relationship with their client. The provisions aim to ensure that clients are able to make informed choices about legal options.[27]

3.28 The Legal Services Board and Commissioner are established by the Uniform Law Application Act and provide an avenue for complaints and independent review. The most common complaints concern costs and communication.[28] Accordingly, many regulations specify how a lawyer can charge for legal services and the information they must give their clients. The obligations cover legal costs, cost disclosure, cost agreements and cost assessments.

3.29 Legal costs must be fair and reasonable, and lawyers must avoid unnecessary delay that results in increased costs. Lawyers must provide an estimate of total legal costs and be satisfied that the client has understood and given consent. Costs information must be provided on an ongoing basis and enable clients to make informed choices about costs and legal options.[29]

3.30 The Uniform Law maintains the prohibition on lawyers charging contingency fees.[30] It contains specific requirements for, and restrictions on, the content of cost agreements, including the content and disclosure of conditional, or ‘no win, no fee’, cost agreements. A ‘no win, no fee’ agreement must contain an estimate of total costs and details of disbursements and uplift fees. It must also identify who has responsibility for paying any adverse costs. Any ‘no win, no fee’ agreement must allow for a cooling-off period of at least five clear days.

3.31 Failure to comply with the obligations under the Uniform Law may result in civil penalties or disciplinary action, including a finding of unsatisfactory professional conduct or professional misconduct.[31] Also, if a lawyer fails to comply with the legal costs provisions, the legal costs agreement may be void and the client would not be required to pay.[32]

3.32 There are some exceptions to the requirements for legal costs disclosure, including to third-party funders and some clients who are considered a ‘commercial or government client’.[33]

Court supervision of proceedings

Common law

3.33 As discussed in Chapter 2, for centuries the activities now undertaken by litigation funders were prohibited by the common law doctrines of maintenance and champerty. Although the doctrines have been abolished, courts can still invalidate a litigation funding agreement on the ground that it is contrary to public policy.[34]

3.34 Courts, therefore, can intervene to prevent an abuse of process. Although they have endorsed litigation funding as a legitimate feature of the legal system, courts can still be wary, as John Walker has explained:

Strong objections to litigation funding, which carry more than an echo of the ancient abhorrence of champerty, are still heard. Some courts and regulators also fear that litigation funding may lead to undesirable ‘trafficking’ in litigation, the misuse or overuse of court resources, the exploitation of vulnerable litigants, the exposure of defendants to unfair risks and the creation of unacceptable conflicts of interest and ethical dilemmas for the lawyers who are being paid by funders.[35]

3.35 The leading decision on whether litigation funders have a legitimate influence on litigation is the High Court’s finding in Campbells Cash & Carry Pty Ltd v Fostif Pty Ltd.[36] The Court endorsed the role of the litigation funder, even though its funding agreement gave it extensive powers over the conduct of the case—including forbidding the lawyer to deal directly with the plaintiffs. The Court held that the judiciary has sufficient powers and processes in place to control any abuse of process or tendency to corrupt justice that

might arise from the involvement of a litigation funder in class actions.[37] However, it rejected the idea that the Court should assess whether a funding agreement is ‘fair’.[38]

3.36 Since then, there has been increasing judicial scrutiny of litigation funding fees. Notably, in Earglow Pty Ltd v Newcrest Mining Ltd Justice Murphy held that the court had the power to approve the proposed settlement of a class action but disallow or reduce the funding fee if excessive.[39] The greater willingness of the court to intervene, and the policy and statutory basis for doing so, are discussed in Chapter 7.

Civil Procedure Act 2010 (Vic)

3.37 Both lawyers and litigation funders are subject to the regulations set out in the Civil Procedure Act 2010 (Vic). The Act specifies a range of ethical and procedural obligations, known as the ‘overarching obligations’, which are subject to judicial oversight. At the commencement of proceedings, lawyers and litigation funders must certify in writing that they have read and understood the overarching obligations.[40]

3.38 A lawyer’s fundamental duty is to the court and to the administration of justice.[41] This duty is paramount and prevails to the extent of inconsistency with any other duty.

3.39 The lawyer’s second fundamental duty is to the client, and it has contractual, professional and fiduciary dimensions. In a class action, the legal practitioner clearly owes proscriptive fiduciary duties to the representative plaintiff and those class members who have signed a retainer.

Overarching purpose and obligations

3.40 The policy intention of introducing the Civil Procedure Act was to ‘redress an imbalance in the civil justice system to achieve essential goals of accessibility, affordability, proportionality, timeliness, and getting to the truth quickly and easily’ through cultural change.[42] The legislation assists judicial officers to manage cases proactively in order to promote an overarching purpose, and guides litigants to resolve disputes without the intervention of the court, or to narrow the issues that are brought to the court to the real issues in dispute. The principal mechanisms it employs to bring about the desired cultural change are the overarching purpose for the courts, and overarching obligations for participants in civil proceedings.

Overarching purpose

3.41 When exercising and interpreting their powers, Victorian courts must aim to give effect to the overarching purpose of the Civil Procedure Act and the rules of court for civil proceedings:[43]

to facilitate the just, efficient, timely and cost-effective resolution of the real issues in dispute.[44]

3.42 In making an order or giving any direction in a civil proceeding, the court must further the overarching purpose by having regard to specific objects that support it[45] and a range of matters concerning, among other things, the conduct of the parties in undertaking the proceedings and in working to resolve the dispute.[46]

3.43 The court also has a broad power to make any order as to costs it considers appropriate to further the overarching purpose.[47] This power is in addition to any other power it has in relation to costs and can be made at any time in a proceeding over any aspect of the proceeding.[48]

3.44 The power to order costs in all proceedings is a commonly exercised power of the courts over litigation funders. The court’s power in relation to costs, including adverse costs and security for costs orders, has been extended to litigation funders where the interests of justice allow a departure from the general rule that only parties to proceedings may be subject to costs orders.[49]

Overarching obligations

3.45 Supporting the ‘overarching purpose’ of the Act are 10 ‘overarching obligations’ that apply to parties, expert witnesses, lawyers and litigation funders involved in civil proceedings.[50] They must:

• act honestly

• only make claims that have a proper basis

• only take steps to resolve or determine the dispute

• cooperate in the conduct of the civil proceeding

• not mislead or deceive

• use reasonable endeavours to resolve the dispute

• narrow the issues in dispute

• ensure costs are reasonable and proportionate

• minimise delay

• disclose the existence of documents critical to the resolution of the dispute.[51]

3.46 The Supreme Court has made it clear that compliance with the overarching obligations is mandatory rather than aspirational.[52] All participants to whom they apply, including litigation funders, must certify that they understand their obligations prior to commencing proceedings.[53]

3.47 The Civil Procedure Act provides the court with broad discretion to impose a cost order or other sanction on a person who contravenes an overarching obligation. If satisfied that a breach has occurred, the court may make ‘any order it considers appropriate in the interests of justice’.[54]

3.48 In considering whether there has been any breach of the overarching obligations, the court is empowered to initiate its own investigation into the breach,[55] and is encouraged to do so. In Yara Australia Pty Ltd v Oswal, the Court of Appeal stated:

The statutory sanctions provide a valuable tool for improving case management, reducing waste and delay and enhancing the accessibility and proportionality of civil litigation. Judicial officers must actively hold the parties to account.[56]

Supreme Court Act 1986 (Vic)

Part 4A

3.49 Part 4A of the Supreme Court Act 1986 (Vic), which establishes the procedures for class actions in Victoria, provides the Supreme Court with powers over commencement, standing, pleadings, adequacy of representation, determination of issues (including individual issues), notice requirements, discontinuance, opting out, costs, settlement and appeals.

3.50 Importantly, the Supreme Court has the very broad power to ‘make any order the court thinks appropriate or necessary to ensure that justice is done in the proceeding’.[57]

3.51 Courts may also use costs as a case management tool in class actions to address vexatious litigation and non-compliant parties.[58]

Supreme Court rules and practice notes

3.52 Supreme Court Rules set out the general practice and procedure of the Court. The Supreme Court (General Civil Procedure) Rules 2015 apply to the way in which class actions are conducted. The operation of these rules does not raise or affect any issues discussed in this paper.

3.53 Particular aspects of the Court’s practice, procedure and organisation are explained in practice notes that operate alongside the rules of court. The practice note that has been issued for class actions is Practice Note SC GEN 10—Conduct of Group Proceedings

(Class Actions).

3.54 The Federal Court’s practice note for class actions is more detailed and comprehensive than the Victorian equivalent.[59] This paper identifies the differences where relevant in exploring possible reform options for Victoria’s class action regime.

Reform options

3.55 Later chapters in this paper explore specific areas of possible reform. However, the Commission encourages submissions that take a broader approach or which introduce new perspectives on the issues arising from the terms of reference. The following general questions invite such wider ranging discussion.

Questions

1 What changes, if any, need to be made to the class actions regime in Victoria to ensure that litigants are not exposed to unfair risks or disproportionate cost burdens?

2 What changes, if any, need to be made to the regulation of proceedings in Victoria that are funded by litigation funders to ensure that litigants are not exposed to unfair risks or disproportionate cost burdens?

3 Should different procedures apply to the supervision and management of class actions financed by litigation funders compared to those that are not?

4 How can the Supreme Court be better supported in its role in supervising and managing class actions?

Conflict of interest

3.56 In proceedings involving a litigation funder, a tripartite relationship is established between the litigation funder, the plaintiff’s lawyer and the plaintiff. It is widely accepted that conflicts of interest will exist in this relationship. These are discussed in detail below.

3.57 In class actions—whether funded or unfunded—lawyers who act for both the representative plaintiff and/or a number of other class members are likely to be exposed to conflicts of interest arising between the competing needs of different class members.

3.58 A more nuanced conflict of interest arises where class actions are ‘instigated’ by law firms. Traditionally, litigation is driven by a client’s interest and a lawyer acts as an agent advocating that interest. The lawyer’s participation is at the invitation or appointment of the client, with the lawyer providing legal advice and opinion but acting on the instructions of the client. The Commission has been told that some lawyers and litigation funders appear to be ‘reverse engineering’ claims. That is, they first establish the legal claim, and then identify the class members that fit within this claim.

3.59 Set out below are conflicts of interest that arise in funded proceedings due to the tripartite relationship between the litigation funder, the lawyers and the funded plaintiff. The existing obligations for managing conflicts of interest imposed on lawyers in class actions (both funded and unfunded) and litigation funders are then discussed in turn. Options for reform identified by the Commission are included at the conclusion of this section, and the Commission welcomes comments on these options, as well as any other ideas for reform in response to the issues raised.

Conflict of interest in the tripartite relationship

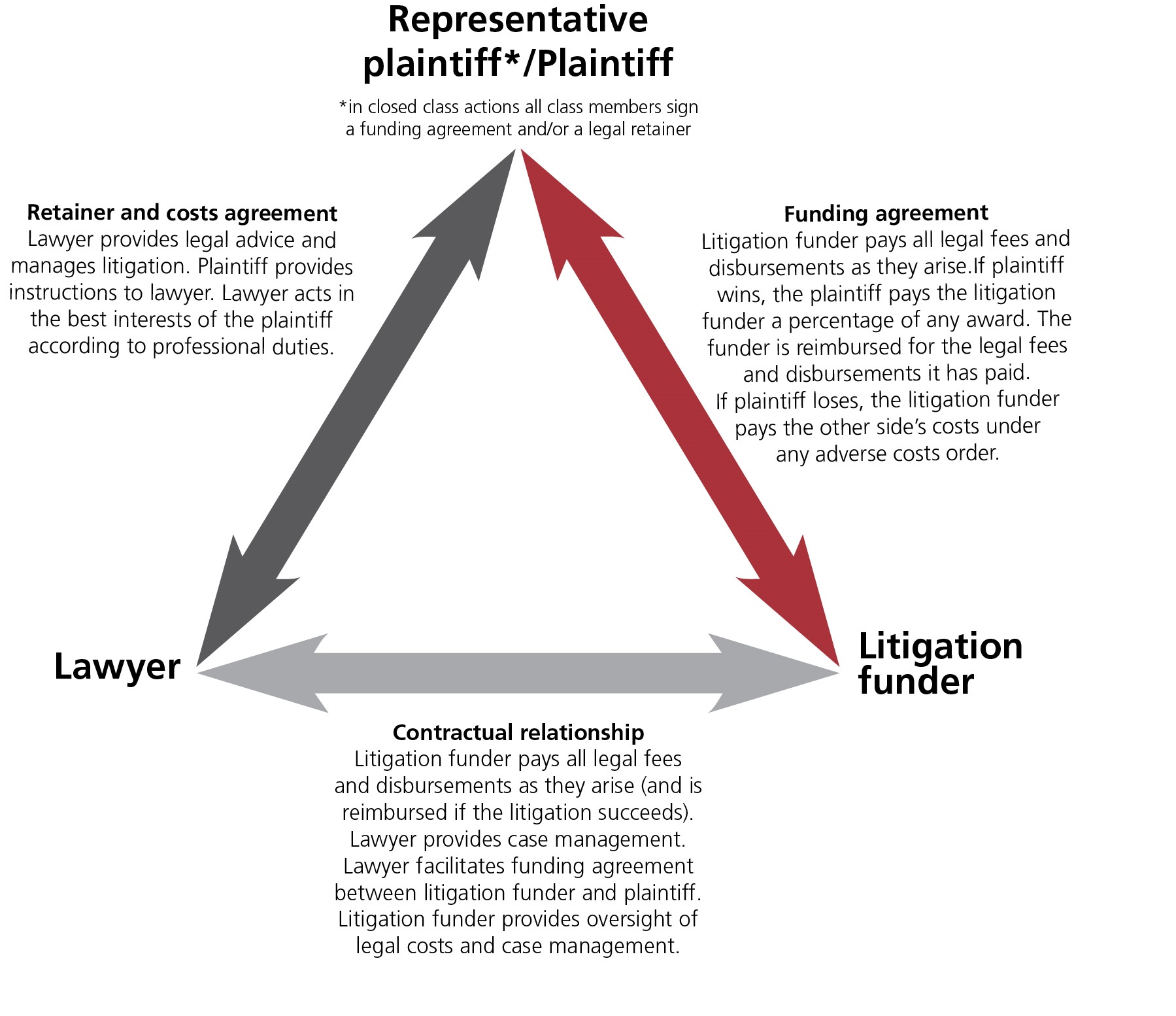

3.60 In the tripartite relationship, the litigation funder and the lawyer are contractually obligated to each other, as well as individually to the plaintiff.[60] This is illustrated in Figure 4.

3.61 Conflicts of interest are particularly likely to arise within this relationship where:

• In a class action, the lawyers act for all class members, who have differing claims and needs which may conflict.

• There is a pre-existing legal or commercial relationship between the litigation funder and lawyers.

• The funder has the control of, or the ability to control, the conduct of proceedings.[61]

3.62 The Commission has been told that in class actions it is common for at least one, if not all, of these factors to exist. Conflicts of interest may affect decision making at various stages of proceedings, as illustrated in the following examples:

• The recruitment of prospective class members. As the litigation funder has an incentive to maximise the number of class members signing up, advertisements may give ‘undue prominence’ to the prospects of success of proceedings.[62] Maximising the number of class members also increases the likely divergence in claims between class members, the expected length and complexity of proceedings, and the potential for lawyers to face conflicts of interest when acting for all class members.

• The terms of any funding agreement. The litigation funder has an incentive to maximise the amount recoverable in the event of a successful outcome, and may wish to participate in decisions affecting the outcome of proceedings. The lawyers will have an incentive to receive legal fees, and the class members will wish to minimise all costs and maximise their return.[63]

• Determination of strategies employed to pursue the claim. The lawyers may consider aspects of the case to have legal merit, yet the litigation funder may not wish to finance these aspects of proceedings. Alternatively, where a representative plaintiff has a weak claim, a defendant may make an offer for discontinuance which, if accepted, would be against the interests of class members with stronger claims.[64]

• Determination of confidential information. The lawyers acting for a class may feel that the best chance of settlement is achieved through disclosure of due diligence carried out by the litigation funder as to the likely success of the claim. For commercial reasons, the funder may not wish such disclosures to be made.[65]

• Settlement. The litigation funder may want to settle, yet class members or lawyers may wish to pursue the legal claim.[66] The types of settlement, including offers of settlement in kind rather than cash, may also cause a conflict between the wishes of the class members and the litigation funder.[67]

• Settlement distribution schemes. While class members have an incentive to receive any amounts from proceedings as soon as possible, the lawyers administering the settlement distribution scheme must assess the merits of individual claims and distribute amounts accordingly. The lawyers continue to incur legal costs during settlement distribution schemes, which will diminish the amounts received by class members.

Figure 4: Example of the tripartite relationship

Conflict of interest for lawyers

3.63 Without obtaining the client’s full and informed consent, a lawyer cannot continue to act for that client where there is a conflict of interest, or a ‘real or substantial possibility’ of a conflict of interest. The conflict could be between the interests of the lawyer and the client (lawyer/duty conflict) or between the interests of two or more clients (duty/duty conflict).

3.64 The obligation on lawyers to avoid conflicts of interest arises under the legislation governing the legal profession,[68] as well as through the axiomatic lawyer–client fiduciary relationship.[69]

3.65 In a class action, it is not only possible but likely that there will be differences between the claims of the representative plaintiff and other class members, as well as between the claims of individual class members.[70] Their circumstances will not be identical and the harm for which they seek damages will be different in degree and also type. The representative plaintiff has responsibilities that other class members do not share. The interests and expectations of unfunded class members will not be the same as those of funded class members.

3.66 In acting for all class members, there is a ‘real or substantial possibility’ that the lawyer may be exposed to duty/duty conflicts arising between the competing needs of various class members.[71]

3.67 Furthermore, in funded class actions, while a funding agreement will generally make it clear that the lawyers act for the funded class member and not the litigation funder,[72] if a litigation funder is paying the legal costs and providing advice about the conduct of proceedings, there is potentially a conflict of interest for the lawyers.[73] The lawyers may also have an incentive to please the litigation funder to attract repeat work.[74]

3.68 While it is relatively easy for a lawyer to obtain full and informed consent to a conflict of interest when acting for a single client, it is virtually impossible to do so when acting in open class action proceedings.[75] Rather than relying on disclosure and consent, it is prudent to either remove the risk or reduce it so that it can be managed better.

3.69 In its 2000 report on managing justice, the Australian Law Reform Commission (ALRC) made several recommendations to reduce the risk that lawyers involved in class actions would face conflicts of interest. It recommended that:

• the Federal Court consider drafting guidelines addressing the obligations of lawyers to the representative plaintiff and each class member regarding the competing interests of class members and the class

• the legal profession develop professional practice rules governing lawyers’ responsibilities to multiple claimants and in class actions

• part IVA of the Federal Court of Australia Act 1976 (Cth) be amended to require class closure at a specified time before judgment.[76]

3.70 The first of these recommendations has been incorporated into the Federal Court Practice Note, which states that any costs agreement should include provisions for managing conflicts of interest (including duty/interest and duty/duty conflicts) between any of the applicant(s), the class members, the lawyers and litigation funders. It also states that lawyers have a continuing obligation to recognise and properly manage any such conflicts throughout proceedings.[77]

3.71 While part IVA of the Federal Court Act has not been amended to require class closure at a specified time before judgment, this will typically happen as a matter of process in funded class actions commencing in the Federal Court.[78] In Victoria, section 33ZG of the Supreme Court Act provides the Court with a specific power to require class members to take specified steps if they wish to benefit from any settlement or judgment amounts recovered.[79]

3.72 The ALRC’s report did not specifically address the issue of conflict of interest for lawyers in funded class actions, possibly because the report predates substantial activity by litigation funders in this type of proceeding.

Conflict of interest for litigation funders

3.73 As discussed earlier in this chapter, litigation funders are not required to hold an Australian Financial Services Licence (AFSL) if they maintain internal processes to manage conflicts of interest that arise in funded proceedings. Failure to maintain adequate practices and follow certain procedures for managing these conflicts is an offence.[80]

3.74 The regulatory guide on complying with this requirement, issued by the Australian Securities and Investments Commission (ASIC), states that disclosure of any conflicts of interest should be made prior to entry into a funding agreement so that prospective plaintiffs can make an informed decision about how the conflict of interest may affect the service being provided to them.[81]

3.75 Disclosure should be ‘timely, prominent, specific and meaningful’[82] and should be ongoing throughout proceedings.[83] The method of disclosure (either paper or electronic) may differ according to the method that best suits the plaintiff.[84]

3.76 In addition to the disclosure made before entering a funding agreement, a litigation funder is also required to ensure that its funding agreements disclose to members the terms of the agreement between the funder and the lawyer.[85]

3.77 The regulatory guide is comprehensive and aligns with the standards required of

AFSL holders. However, doubts have been raised about whether the current

‘light touch’ regulation is sufficient to protect the interests of plaintiffs. The Commonwealth Government’s post-implementation review uncovered unfavourable views about the scheme:

Some stakeholders consider the Regulation merely duplicates existing conflict of interest legislation and has not changed behaviour, while increasing compliance costs. Others have argued that the Regulation does not achieve its objective, in part because of inadequate powers given to ASIC to enforce the provisions.[86]

3.78 The utility of conflict of interest disclosures for class members has also been questioned by Professors Vince Morabito and Vicki Waye, who have expressed the view that ‘disclosing conflicts of interest rarely enhances rational consumer decision making and … disclosure may in fact lull consumers into a false sense of security’.[87]

3.79 These criticisms are about how the industry is regulated, a matter that is within the Commonwealth’s jurisdiction. The Commission has not identified any need or scope under Victorian law to augment the conflict of interest guidelines but would welcome comments to the contrary.

Reform options

3.80 The Commission has identified from commentary on the subject three possible options for reform to reduce or remove conflicts of interest in funded proceedings and class actions. They are put forward for discussion and the Commission would welcome further reform ideas as well as, or instead of, these options:

• The Supreme Court could draft guidelines addressing the responsibilities of lawyers in class actions.

• The legal profession could draft guidelines addressing the responsibilities of lawyers in class actions.

• The Supreme Court could introduce practice requirements for litigation funders involved in class actions in relation to conflicts of interest.

Supreme Court guidelines for lawyers in class actions

3.81 The Supreme Court could draft specific guidelines addressing lawyers’ responsibilities to the representative plaintiff and each class member regarding the competing interests of class members and the class. The guidelines could clarify responsibilities in both funded and unfunded class actions. This idea is based on a recommendation by the ALRC in 2000 that the Federal Court draft guidelines of this nature.

3.82 Either in addition or alternatively, the Supreme Court could ensure that lawyers in class action proceedings have procedures in place for managing conflicts of interest during the proceedings. This option has been adopted by the Federal Court. The Federal Court Practice Note requires legal retainers and litigation funding agreements to include provisions for managing conflicts of interest. It does not provide detail on how the risk of conflicts of interest can be reduced.

Legal profession guidelines for lawyers in class actions

3.83 This option was also recommended by the ALRC in 2000. As Victorian lawyers are now governed under uniform law with the legal profession in New South Wales, it is not solely a matter of Victorian jurisdiction.

Supreme Court practice requirements for litigation funders involved in class actions

3.84 This option would see the Supreme Court introduce obligations for litigation funders that are involved in proceedings in relation to conflicts of interest. These obligations would apply in addition to the disclosure obligations provided at a Commonwealth level in ASIC’s regulatory guidance.

3.85 The Federal Court Practice Note states that any litigation funding agreement should include provisions for managing conflicts of interest between the funded class members, the lawyers and the litigation funder. The obligation to recognise and properly manage any conflicts of interest is placed on the lawyers, as opposed to the litigation funder.

Question

5 Is there a need for guidelines for lawyers on their responsibilities to multiple class members in class actions? If so, what form should they take?

-

Hospital Products Ltd v United States Surgical Corporation (1984) 156 CLR 41, 96–7 (Mason J).

-

Simone Degeling and Michael Legg, ‘Fiduciaries and Funders: Litigation Funders in Australian Class Actions’ (2017) 36 Civil Justice Quarterly 244.

-

Pilmer v Duke Group Ltd (in liq) (2001) 207 CLR 165, 199 [78] (McHugh, Gummow, Hayne and Callinan JJ).

-

Corporations Act 2001 (Cth) ss 793C, 1101B. The Commission has identified four litigation funders listed on the ASX: Hillcrest Litigation Services Ltd; IMF Bentham Ltd; JustKapital Litigation Partners Ltd; and Litigation Capital Management Ltd.

-

Corporations Act 2001 (Cth) s 911A.

-

Corporations Regulations 2001 (Cth) regs 7.1.04N, 7.6.01(1)(x), 7.6.01(1)(y), 7.6.01AB.

-

Brookfield Multiplex Ltd v International Litigation Funding Partners Pte Ltd (2009) 180 FCR 11.

-

International Litigation Partners Pte Ltd v Chameleon Mining NL (2011) 276 ALR 138.

-

International Litigation Partners Pte Ltd v Chameleon Mining NL (rec and mgr apptd) [2012] HCA 4.

-

The Treasury, Australia, ‘Government Acts to Ensure Access to Justice for Class Action Member’ (Media Release, No 039, 4 May 2010).

-

The Treasury, Australia, Post-Implementation Review—Litigation funding—Corporations Amendment Regulations 2012 (No 6) (October 2015) <http://ris.pmc.gov.au/2016/03/15/litigation-funding>.

-

Corporations Regulations 2001 (Cth) reg 7.6.01AB(2).

-

Ibid reg 7.6.01AB(3).

-

Ibid reg 7.6.01AB(4)(e).

-

Australian Securities and Investments Commission, Regulatory Guide 248: Litigation Schemes and Proof of Debt Schemes: Managing Conflicts of Interest (April 2013).

-

Australian Securities and Investments Commission Act 2001 (Cth) s 12BAA (definition of ‘financial product’), s 12BAB (definition of ‘financial service’).

-

Ibid ss 12BF–12BM. These provisions apply to a ‘consumer contract’ which, as defined, would rarely apply to a litigation funding agreement: John Walker, ‘Policy and Regulatory Issues in Litigation Funding Revisited’ (2014) 55 Canadian Business Law Journal 85, 95.

-

Australian Securities and Investments Commission Act 2001 (Cth) ss 12CA–12CC.

-

Ibid ss 12DA, 12DB, 12DF.

-

Ibid ss 12ED(1).

-

John Walker, ‘Policy and Regulatory Issues in Litigation Funding Revisited’ (2014) 55 Canadian Business Law Journal 85, 94.

-

As noted above, the Commission has identified four litigation funders currently listed on the ASX. No litigation funder holds an AFSL. IMF Bentham Ltd held a AFSL from 4 July 2005 through to 18 April 2013: IMF (Australia) Ltd, ‘Australian Financial Services Licence’ (Release to Australian Securities Exchange (ASX), 19 April 2013) <www.imf.com.au/docs/default-source/site-documents/australian-financial-services-licence>; Kate Kachor, ‘IMF voluntarily cancels AFSL’, Financial Observer (online), 22 April 2013 <www.financialobserver.com.au/articles/imf-voluntarily-cancels-afsl>.

-

See, eg, Productivity Commission, Access to Justice Arrangements, Inquiry Report No 72 (2014); Law Council of Australia, Regulation of Third Party Litigation Funding in Australia, Position Paper (June 2011); Wayne Attrill, ‘The Regulation of Conflicts of Interest in Australian Litigation Funding’ (2013) 2 Journal of Civil Litigation and Practice 193; Michael Legg et al, ‘The Rise and Regulation of Litigation Funding in Australia’ (2011) 38 Northern Kentucky Law Review 625; John Walker, ‘Policy and Regulatory Issues in Litigation Funding Revisited’ (2014) 55 Canadian Business Law Journal 85.

-

The Association of Litigation Funders of England and Wales, Code of Conduct for Litigation Funders, November 2016 [9.4.1]–[9.4.5]; Rachael Mulheron, ‘England’s Unique Approach to the Self-Regulation of Third Party Funding: A Critical Analysis of Recent Developments’ [2014] 73 Cambridge Law Journal 570, 574–5.

-

Productivity Commission, Access to Justice Arrangements, Inquiry Report No 72 (2014) vol 2, 631.

-

Ibid 632.

-

Legal Profession Uniform Law Application Act 2014 (Vic) sch 1 (‘Legal Profession Uniform Law’) s 174; Legal Profession Uniform General Rules 2015 (Vic) r 7.

-

Victorian Legal Services Board, Annual Report (2016) 56.

-

Cost disclosure obligations are regulated according to threshold amounts. Estimated costs over $3000 require comprehensive and ongoing written disclosure: Legal Profession Uniform Law Application Act 2014 (Vic) sch 1 (‘Legal Profession Uniform Law’) s 174, sch 4 s 18.

-

A law practice must not enter into a costs agreement under which the amount payable to the law practice, or any part of that amount, is calculated by reference to the amount of any award: Legal Profession Uniform Law Application Act 2014 (Vic) sch 1 (‘Legal Profession Uniform Law’) s 183(1).

-

Legal Profession Uniform Law Application Act 2014 (Vic) sch 1 (‘Legal Profession Uniform Law’) s 298.

-

Ibid sch 1 Legal Profession Uniform Law s 178.

-

Ibid sch 1 Legal Profession Uniform Law s 170.

-

Wrongs Act 1958 (Vic) s 32(2).

-

John Walker,’ Policy and Regulatory Issues in Litigation Funding Revisited’ (2014) 55 Canadian Business Law Journal 85, 90.

-

(2006) 229 CLR 386.

-

Ibid.

-

Ibid [92].

-

Earglow Pty Ltd v Newcrest Mining Ltd [2016] FCA 1433 (28 November 2016) [7].

-

Civil Procedure Act 2010 (Vic) s 41(1).

-

Ibid s 16; Legal Profession Uniform General Rules 2015 (Vic) r 3.

-

Explanatory Memorandum, Civil Procedure Bill 2010 (Vic).

-

Civil Procedure Act 2010 (Vic) s 8.

-

Ibid s 7(1).

-

Ibid s 9(1).

-

Ibid s 9(2).

-

Ibid s 65C(1)

-

Ibid s 65C(1)

-

G E Dal Pont, Law of Costs (LexisNexis Butterworths, 3rd ed, 2013) 753–4.

-

Civil Procedure Act 2010 (Vic) s 10.

-

Ibid ss 17–26.

-

Yara Australia Pty Ltd v Oswal (2013) 41 VR 302, 308.

-

Ibid s 41.

-

Ibid s 29.

-

Ibid s 29(2)(b).

-

Yara Australia Pty Ltd v Oswal (2013) 41 VR 302, 311.

-

Supreme Court Act 1986 (Vic) s 33ZF.

-

Productivity Commission, Access to Justice Arrangements, Inquiry Report No 72 (2014) vol 1, 454.

-

Federal Court of Australia, Class Actions Practice Note (GPN–CA)—General Practice Note, 25 October 2016.

-

Funded class actions may reveal some variations on this tripartite arrangement, depending upon the type of class action commenced. In an open class action, the litigation funder and the lawyer will each enter into agreements with the representative plaintiff and some (but not all) of the class members. In a closed class action, the litigation funder and the lawyers will each enter into agreements with the representative plaintiff as well as all the class members. Litigation funders are generally only prepared to fund closed class actions: Money Max Int Pty Ltd (Trustee) v QBE Insurance Group Ltd (2016) 245 FCR 191, 227-8 [185].

-

Australian Securities and Investments Commission, Regulatory Guide 248—Litigation Schemes and Proof of Debt Schemes: Managing Conflicts of Interest (April 2013) 8.

-

Ibid [248.14(a)].

-

Ibid [248.11], [248.14(b)].

-

Ibid [248.14(c)].

-

Vicki Waye, ‘Conflicts of Interest Between Claimholders, Lawyers and Litigation Entrepreneurs’ (2007) 19(1) Bond Law Review 225, 238.

-

Australian Securities and Investments Commission, Regulatory Guide 248: Litigation Schemes and Proof of Debt Schemes: Managing Conflicts of Interest (April 2013) 8 [248.14(b)(d)].

-

Vicki Waye, ‘Conflicts of Interest Between Claimholders, Lawyers and Litigation Entrepreneurs’ (2007) 19(1) Bond Law Review 225, 238.

-

Legal Profession Uniform General Rules 2015 (Vic) r 11.3.

-

See, eg, Hospital Products v United States Surgical Corporation (1984) 156 CLR 41.

-

The Victorian class action regime specifically provides for the determination of common as well as individual issues as part of class action proceedings: Supreme Court Act 1986 (Vic) ss 33Q–33R.

-

Simone Degeling and Michael Legg, ‘Fiduciary Obligations of Lawyers in Australian Class Actions: Conflicts Between Duties’ (2014) 37 University of New South Wales Law Journal 914.

-

Simone Degeling and Michael Legg, ‘Fiduciaries and Funders: Litigation Funders in Australian Class Actions’ (2017) 36 Civil Justice Quarterly 244, 246.

-

See, eg, Vicki Waye, ‘Conflicts of Interests between Claimholders, Lawyers and Litigation Entrepreneurs’ (2007) 19(1) Bond Law Review 225.

-

Ibid 237.

-

Simone Degeling and Michael Legg, ‘Fiduciary Obligations of Lawyers in Australian Class Actions: Conflicts Between Duties’ (2014) 37 University of New South Wales Law Journal 914.

-

Australian Law Reform Commission, Managing Justice: A Review of the Federal Civil Justice System, Report No 89 (2000) 551, 553.

-

Federal Court of Australia, Class Actions Practice Note (GPN–CA)—General Practice Note, 25 October 2016, 4.

-

See, eg, Money Max Int Pty Ltd (Trustee) v QBE Insurance Group Ltd (2016) 245 FCR 191, 228-9 [189]. Simone Degeling and Michael Legg have also argued that the only way to ensure that the risk of duty/duty conflicts for lawyers is completely excluded is to pursue class actions via a closed class. Alternatively, they have suggested amending part IVA to allow the class to be defined more narrowly, or to allow for greater fragmentation of class members and legal representation: Simone Degeling and Michael Legg, ‘Fiduciary Obligations of Lawyers in Australian Class Actions: Conflicts Between Duties’ (2014) 37 University of New South Wales Law Journal 914.

-

Supreme Court Act 1986 (Vic) s 33ZG; Matthews v SPI Electricity Pty Ltd and SPI Electricity Pty Ltd v Utility Services Corporation Ltd (Ruling No 13) [2013] VSC 17 [63]–[68].

-

Corporations Amendment Regulation 2012 (No 6) (Cth). In addition to the statutory requirements to disclose any conflicts of interest, Degeling and Legg argue that a litigation funder may be under an obligation to avoid conflicts of interest with class members under fiduciary obligations. While they note that litigation funders will routinely attempt to exclude the possibility of a fiduciary relationship in the funding agreement, they suggest that the fiduciary relationship arises prior to the entry into the funding agreement. See Simone Degeling and Michael Legg, ‘Fiduciaries and Funders: Litigation Funders in Australian Class Actions’ (2017) 36 Civil Justice Quarterly 244.

-

Australian Securities and Investments Commission, Regulatory Guide 248 – Litigation Schemes and Proof of Debt Schemes: Managing Conflicts of Interest (April 2013) 18–19 [248.59]–[248.61].

-

Ibid.

-

Ibid [248.56].

-

Ibid 17–18 [248.52]–[248.55].

-

Ibid 21 [248.71].

-

The Treasury, Australia, Post-Implementation Review—Litigation funding—Corporations Amendment Regulation 2012 (No 6)

(October 2015) 23.

-

Vince Morabito and Vicki Waye, ‘Seeing Past the US Bogey—Lessons from Australia on the Funding of Class Actions’ (2017) 36 Civil Justice Quarterly 213, 235.

|

|